In the intricate dance of economic policy, few instruments wield as much influence as taxation. It’s the lifeblood of government operations, the mechanism through which nations fund essential services, infrastructure, and development initiatives.

In Kenya, where the pursuit of fiscal sustainability and economic growth is paramount, the formulation and implementation of a robust National Tax Policy couldn’t be timelier.

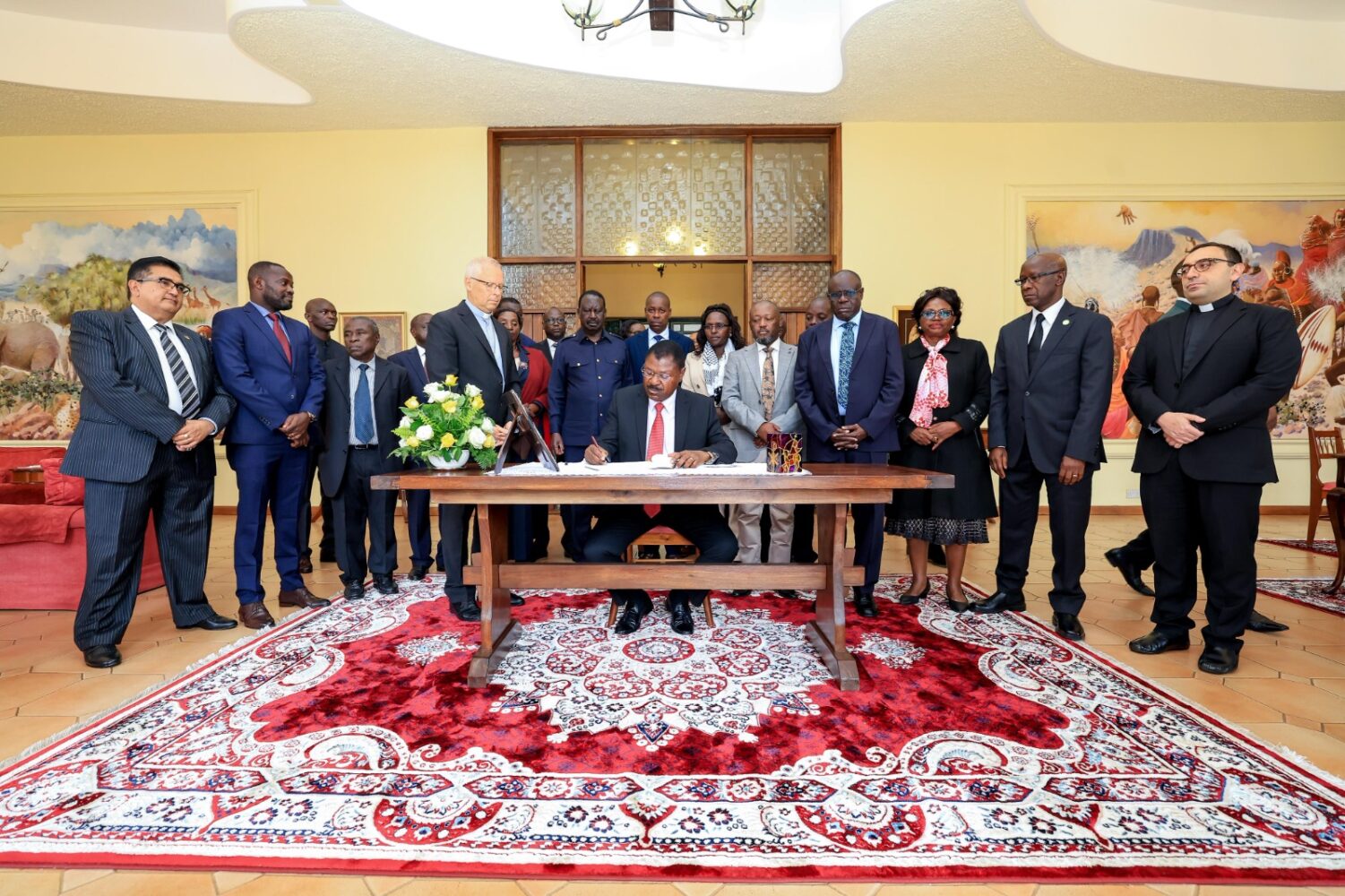

At its fundamental, the National Tax Policy is a roadmap, a strategic blueprint that delineates the principles and parameters governing taxation in Kenya. It’s not merely a bureaucratic document; it’s a dynamic tool for revenue mobilization, designed to support the government’s priority programs and spur sustainable development under the Bottom-Up Economic Transformation Agenda.

Globally, governments are constantly seeking innovative strategies to bolster their revenue streams. Effective governance demands the ability to finance critical public projects and deliver services in a timely and coordinated manner without exposing the citizenry to much turmoil.

In an ideal scenario, the quality of services from the Government to the people should mirror the amount of taxes collected from the citizenry. The expectation therein is that revenue mobilized on behalf of the Government is effectively utilized to elevate the quality of life in the society; in terms of investment in critical infrastructure, health, education, security and safety of citizens.

The challenges confronting Kenya’s tax system are complicated and pressing. Despite substantial investments aimed at modernization and reform, revenue collection remains below the East African Community’s target of 25 percent of GDP.

The gap between potential and actual revenue generation underscores the urgency of addressing systemic issues and inefficiencies within the taxation framework.

Taxation is mostly viewed as an equalizing principle. All citizens are expected to remit their share of taxes to the government, pegged on the tax regime applicable to the sectors within which they derive an income.

More often than not, some sectors are not fully explored and brought into the tax net given the intricate value chain and business eco systems that they operate in. Most Governments and tax administrations still grapple with this reality that in turn tends exerts more pressure on the easily accessible and understood sectors when it comes to application of the tax code.

To address the disproportionate revenue yield per sector and fairly distribute the tax load, the national tax policy is critical to protect and enhance domestic resource mobilization required to finance the Government development agenda and reduce fiscal deficit.

A robust taxation framework therefore serves as the cornerstone of this endeavour, facilitating the equitable distribution of financial burdens while fostering economic stability.

Among the key challenges highlighted in the National Tax Policy are the burgeoning tax expenditures, complexities in taxing emerging digital economies, low compliance rates, international tax challenges, and delays in resolving tax disputes.

These issues not only hamper revenue collection but also erode trust in the tax system and hinder economic progress. The Policy offers a comprehensive suite of solutions tailored to address these challenges head-on.

From instituting regular tax law reviews to developing frameworks for granting tax incentives and guiding principles for international tax negotiations, it provides a roadmap for reform and modernization. By enhancing predictability, reducing complexities, and bolstering compliance, these measures aim to optimize revenue generation and ensure the equitable distribution of tax burdens.

The true test now lies in the effective implementation of these policy prescriptions. Success hinges not only on the actions of the National Treasury and the Kenya Revenue Authority but also on the collaboration and commitment of a diverse array of stakeholders, including the National Assembly, the Judiciary, county governments, and various Government Ministries and Agencies.

Crucially, the Policy emphasizes the need for robust monitoring and evaluation mechanisms to track progress and hold implementers accountable. Transparency and accountability are the cornerstones of effective governance, ensuring that policies translate into tangible outcomes for the citizenry.

In embracing the National Tax Policy, Kenya has an opportunity to fortify its fiscal resilience, stimulate economic growth, and foster social cohesion.

By aligning taxation with national development objectives, the Policy can catalyse investment, innovation, and inclusive prosperity.

The Writer is Communication Lead in Nairobi