CIC Insurance Group, a member of the UN Global Compact Network Kenya and the Nairobi Declaration on Sustainable Insurance, has released its inaugural sustainability report. The report highlights CIC’s commitment to developing sustainable products and services that equip customers and communities with resilient risk management solutions.

The report, part of the company’s long-term sustainability strategy, aims to increase microinsurance policies at CIC Group to 25 percent by 2030, achieve gender balance across the workforce by 2030, and increase the percentage of revenue spent on Social Investment for greater impact among other commitments.

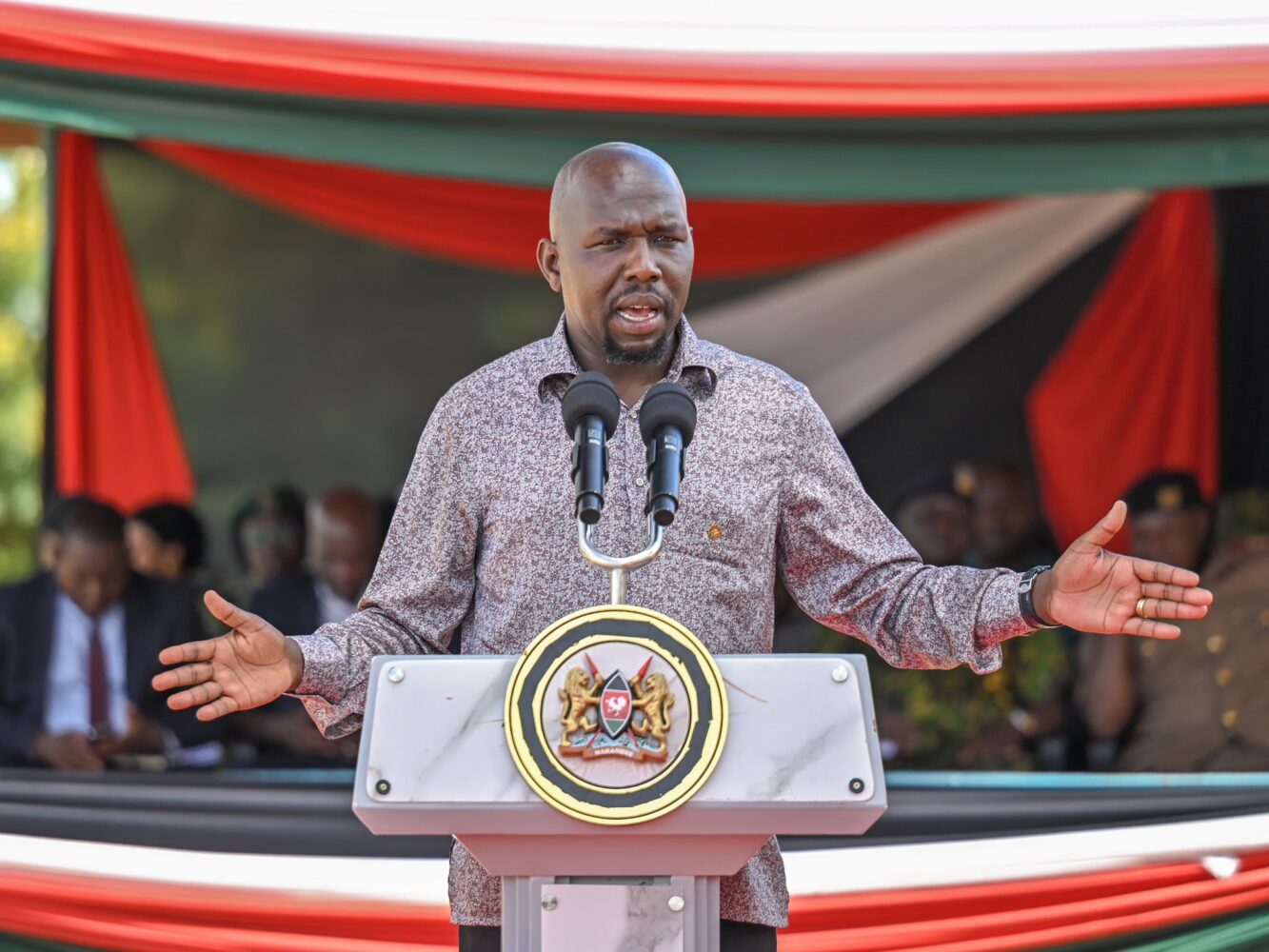

Speaking during the launch event, Mr. Patrick Nyaga, Group Managing Director and CEO, CIC Group said, “Our sustainability strategy is deeply rooted in the cooperative values that shape who we are as an organization. We acknowledge that our sustainability efforts need to support our customers who include cooperatives, to achieve affordable and sustainable risk management. Our solutions are therefore geared towards innovating products that address emerging risks such as climate change and tailoring them to fit the needs of different audiences.”

The report recognizes commitments CIC Group made to the Global Sustainability Initiatives by becoming signatories to the United Nations Global Compact (UNGC) Network Kenya and the Nairobi Declaration on Sustainable Insurance (NDSI). The Company has invested in low-carbon technologies like laptops to replace desktop computers and has retrofitted all lighting to conserve energy as well as installing a solar-powered pump at its Ushirika Gardens project.

Dr Nelson Kuria, Group Chairman at CIC Group added, “The Group facilitated 40 training sessions to the senior management and board members of various co-operatives on risk management, digital lending and emerging trends, financial wellness and cyber security.”

‘’CIC Group has continued to insure agriculture growing premiums significantly and keeping our word by paying claims thus derisking farmers on losses suffered due to adverse weather related events,’’ added Mr. Nyaga.

Other social impact products on offer include Co-opcare, a medical product for Cooperative members and their affiliates with a minimum membership of 10 principal members, Uganda’s Kameeza, a low-cost funeral expense cover designed for the policyholder and their immediate family members, Malawi’s Abwenzi, a health product targeting women and their families and the Seniors Mediplan(Kenya), a specialised health insurance product for senior citizens over 60 years, with no age limit once someone is on cover.

Moving Forward

CIC’s sustainability journey is guided by its 2025 – 2030 long-term strategy built on four sustainability pillars: Environmental Stewardship, Social Responsibility, Economic Resilience, and Responsible Governance.

The strategy sets ambitious goals for 2030 including:

1. Encouraging community development through CIC Foundation

2. Supporting local entrepreneurship

3. Fostering sustainable practices

4. Promote diversity, equality and inclusion

5. Improving employee engagement index

6. Enhancing customer engagement

Under the six broad goals, CIC Group has developed specific targets to be achieved by 2030 including: Increasing microbusiness policies proportion at CIC to 25%, reducing waste diverted to landfill by 25%, reducing Scope 1 and 2 GHG emissions by 30%, achieving gender balance across the workforce, achieving a representation of PWD of at least 1% of the total workforce and improving customer satisfaction index to 90%.