The Competition Authority of Kenya (CAK) has ordered asset financier Mogo Auto Limited to pay a pecuniary penalty of KES. 10,851,473.20 for violating the Competition Act CAP 504 (‘the Act’) by engaging in false and misleading representation and unconscionable conduct against its customers.

Mogo, which was incorporated in Kenya in 2012, is part of the Eleving Group, an international FinTech company operating in 15 countries across three continents; Europe, Asia and Africa.

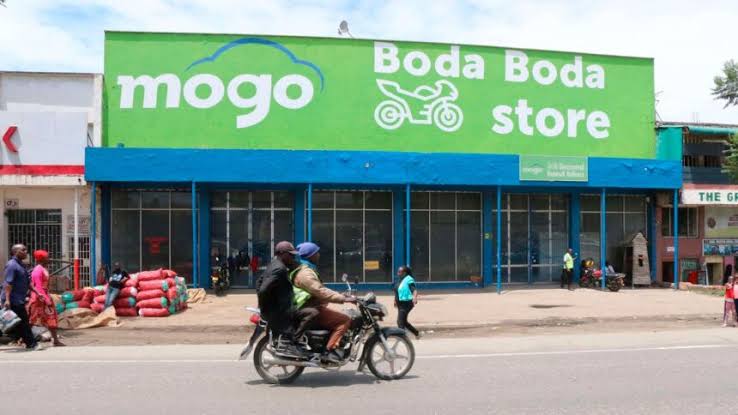

In Kenya, the company has presence in eight counties. Its main products are car financing, logbook loans and offering loans to bodaboda and tuktuk operators.

In addition to the aforementioned penalty, Mogo has been directed to refund three loan customers KES. 344,939, being the sum of excess amounts charged in repayment of their facilities, and the difference in the dollar exchange rate applied during issuance.

Mogo has also been directed to; refrain from misrepresenting facts and engaging in unconscionable conduct when dealing with its clients, amicably resolve all pending complaints before the Authority, and resolve future complaints expeditiously.

Investigations into Mogo’s conduct were occasioned by complaints lodged with the Authority by the financier’s four customers on varied dates between 6th May, 2023 and 11thApril, 2024.

The first complainant alleged that they applied for a loan in June 2022. The facility of KES.2,100,000, (USD 17,828.16 at the exchange rate of KES. 117 to USD 1) was payable in sixty (60) monthly instalments at a 2.6% flat interest rate.

The complainant accused Mogo of adjusting the terms from flat rate to reducing balance basis, and that the interest payable was calculated in USD, despite the facility being disbursed in KES.

This adjustment, they claimed, caused payment of unpredictable amounts due to foreign exchange fluctuations.

The second complainant claimed taking a KES. 300,000 facility in July 2021. After repaying for twenty (20) months, the complainant requested for a statement with the aim of settling the loan in full.

The loan statement indicated a balance of KES. 392,000. In addition, the amount repayable had been computed in USD despite being disbursed in KES. The complainant settled the loan, but allegedly paid more than contracted.

The third complainant asserted that Mogo financed 50% (KES. 310,000) of the purchase price of a motor vehicle. The facility was disbursed in KES., but the loan agreement captured two currencies – KES. and USD.

The complainant alleged that Mogo explained that the dollar tabulation was for record-keeping. However, subsequently, Mogo calculated the loan installment amounts in USD and required the complainant to pay in KES.

Further, the complainant claimed Mogo did not furnish them with the loan agreement and introduced a new document (General Provisions), which was not availed during the initial negotiations.

Lastly, the fourth complainant entered into a KES. 517,212 loan agreement with Mogo in June 2022. The complainant serviced the loan for seven (7) months after which their facility balance was tabulated as KES. 726,000.

As was the case with the other complainants, the loan was disbursed in KES. but repayable in USD, exposing them to higher instalments.

The complainant further alleged that Mogo unilaterally varied the interest rate from 2.5% (flat rate) to 3.85% (reducing balance), contrary to the contract terms.

Upon reviewing the four complaints, the Authority initiated an investigation, informed Mogo of the allegations and invited them to respond to the accusations.

The investigation was premised on possible violation of section 55(b)(i) of the Act, on false or misleading representations and sections 56(1) and 56(3) of the Act on unconscionable conduct.

Mogo made written and oral submissions to the Authority. Upon analyzing the evidentiary information from the complainants and the accused party, the Authority concluded that Mogo had violated the Act, specifically clauses prohibiting false or misleading representations, and engaging in unconscionable conduct during issuance and administration of loan products to the complainants.

Upon being issued with a Notice of Proposed Decision by the Authority, Mogo indicated amenability to settle the matter administratively. Section 38 of the Act provides that the Authority may, at any time during or after an investigation into an alleged infringement, enter into an agreement of settlement with the undertaking(s) concerned.

The Authority’s penalization and settlement process is guided by the Consolidated Competition Administrative Remedies and Settlement Guidelines. The Authority may impose a penalty of up to 10% of a business’ preceding year’s gross annual turnover. This is the highest allowable penalty under the Act, and is in line with international best practice.

When determining the applicable penalty, the Authority considers the mitigating and aggravating factors specific to the case.

Mitigating factors support a party’s bid to have their fine reduced as much as possible from the permissible 10%. Aggravating factors increase the penalty.

Mitigating factors include; cooperation, first time offender, inadvertent breach, conduct terminated in course of investigation, self-reporting, and willingness to acknowledge liability.

Aggravating factors include; impact, coverage and duration of contravention, repeat offender, non-cooperation, conduct ongoing during investigation, impact on SMEs, retaliation against complainants.

Upon considering the foregoing, the Authority and Mogo entered into a settlement agreement in which the financial services provider has been ordered to; Pay a penalty of KES. 10,851,473.20; Remedy the complainants as follows;• First complainant to pay Mogo KES. 500,000 as the final outstanding loan amount, payable in four equal monthly installments;• Second complainant to be refunded KES. 108,745.1 being the excess amounts charged by Mogo at the time of entering a settlement with the Authority; and• Third complainant and fourth complaint to be refunded KES. 80,915 and KES. 155, 279, respectively, being the difference between the exchange rate applied during loan application and issuance.

Other resolutions include; Amicably resolve all the pending complaints lodged at the Authority, resolve any future complaint within the stipulated timelines, and refrain from engaging in similar conduct in future and Mogo and its employees to undergo consumer compliance training by 30th August 2025.