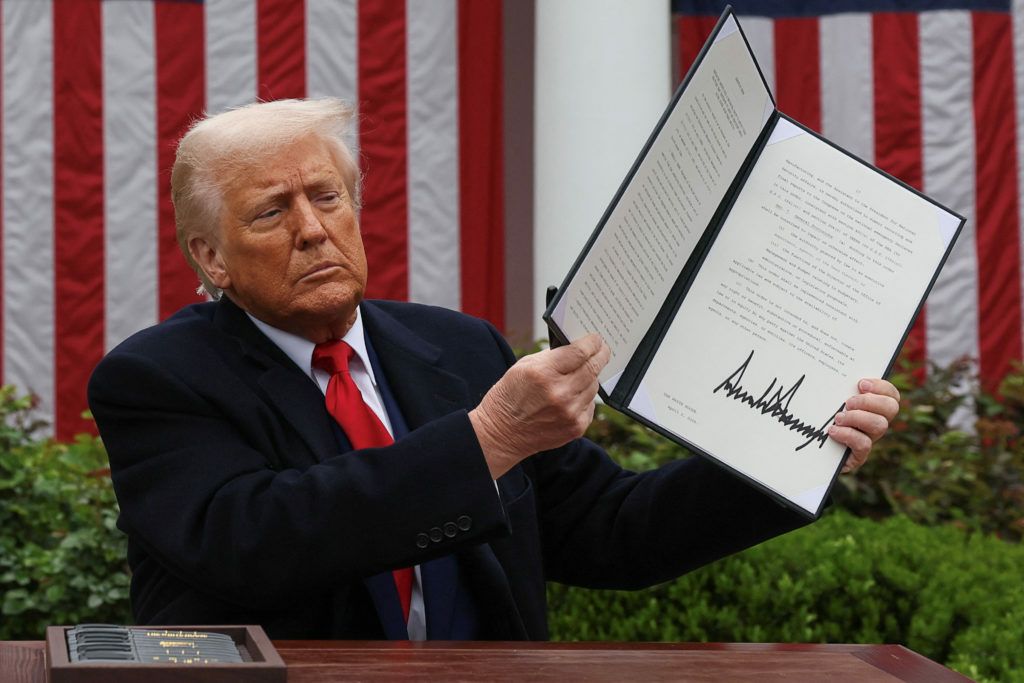

Elon Musk, the world’s richest man and a key adviser to President Donald Trump on cost-cutting measures, has suffered a staggering blow to his net worth following a sharp decline in Tesla’s stock value.

As markets reacted to Trump’s new tariffs on Canada, China, and Mexico, shares of Musk’s electric car company continued their downward spiral, significantly reducing his wealth.

Fortune in freefall

Musk’s net worth plummeted by $7.1 billion on Tuesday alone, bringing his total fortune to $347.7 billion, according to Forbes’ real-time estimates.

This marks a dramatic decline of $116.3 billion from his peak wealth of $464 billion, recorded on December 17, when Tesla stock reached an all-time high of $480 per share.

Since then, Tesla’s stock has been in freefall, closing at $272 on Tuesday—its lowest end-of-day price since Election Day.

The decline coincided with the S&P 500’s drop of over 1%, reflecting investor anxiety over the economic impact of Trump’s aggressive trade policies.

To put the loss into perspective, Musk’s $116 billion drop exceeds the entire fortune of Microsoft co-founder Bill Gates, who is currently worth $108.1 billion.

It also surpasses the wealth of Asia’s richest man, India’s Mukesh Ambani, whose net worth stands at $85.6 billion.

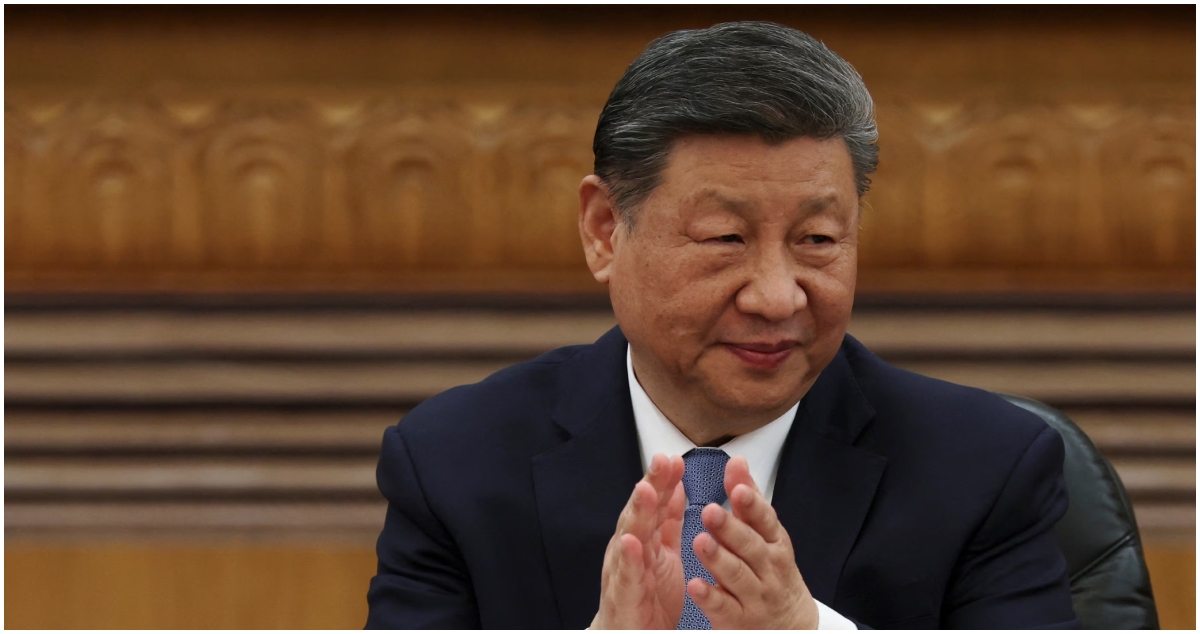

Tariffs and Tesla’s troubles

Tesla is particularly vulnerable to the new trade tariffs, as China represents its second-largest market for electric vehicles.

Additionally, the company relies heavily on Canadian imports for its production.

Tesla’s Chief Financial Officer Vaibhav Taneja previously warned that tariffs would “have an impact on our business and profitability,” emphasizing the company’s dependence on global supply chains.

Despite the downturn, Musk remains significantly wealthier than he was on Election Day, still holding an $83.3 billion gain compared to that time.

The increase is partly due to the rising valuations of his private ventures, including SpaceX and xAI.

However, Tesla’s initial post-election surge, driven by investor optimism over Musk’s $300 million donation to Trump’s campaign and anticipated regulatory benefits, has largely faded.

As the market volatility continues, Tesla faces mounting challenges, with investors watching closely to see whether Musk can steer the company through the storm or if further losses are on the horizon.