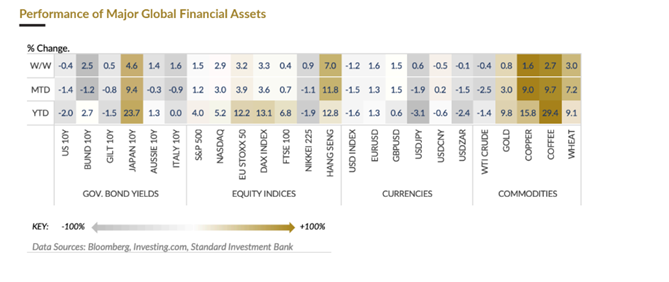

European stocks have been staging a significant comeback after lagging behind the U.S. equity market in recent years, this is according to a report by the Standard Investment Bank (SIB).

The European index rose by 3.15% in the previous week, bringing its year-to-date gains to an impressive 12.20%. In contrast, the S&P 500 has only managed to achieve just under 4% in the same period.

This shift in performance, Dan Murage – a global analyst at SIB says, can be attributed to several factors. Firstly, European markets have benefited from a more favorable economic environment, including robust corporate earnings and improved consumer sentiment. Additionally, the European Central Bank’s monetary policies may have provided a supportive backdrop for growth. Investors are also increasingly attracted to European equities due to their relatively low valuations compared to U.S. stocks, making them an appealing option for diversification in investment portfolios.

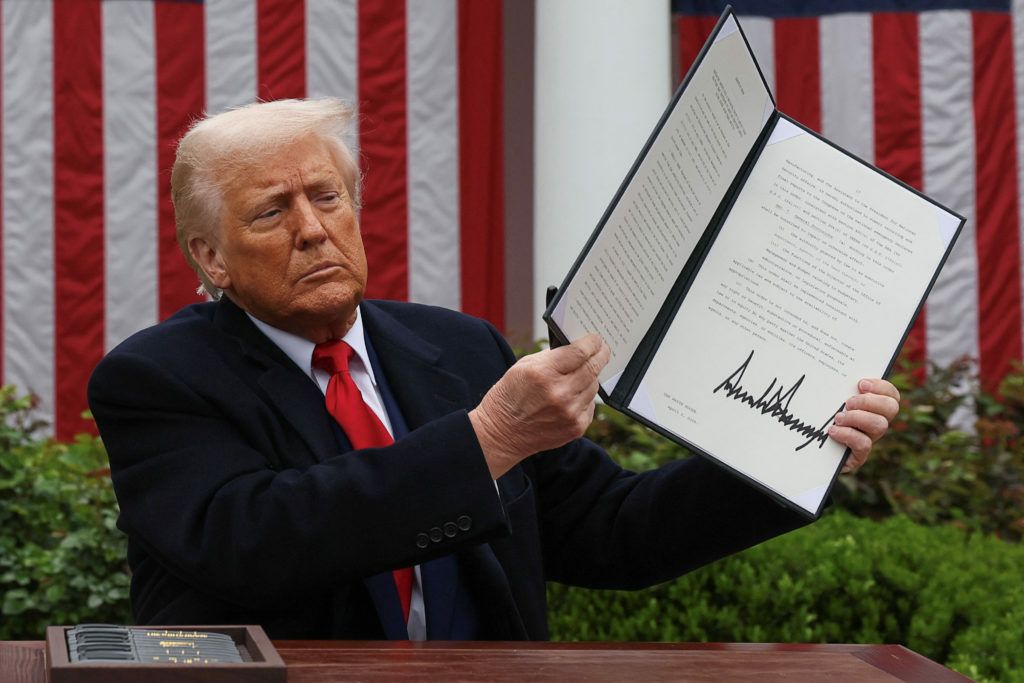

Optimism surrounding a potential resolution to the Russia-Ukraine war, combined with strong earnings reports, has significantly lifted market sentiment. Additionally, the U.S. President Donald Trump’s decision to shift from imposing global blanket tariffs to implementing reciprocal tariffs on a country-by-country basis has alleviated some of the negative implications previously feared.

Reciprocal tariffs mean that instead of applying the same tariffs uniformly to all countries, the President is now choosing to negotiate trade terms individually with each country. This approach allows for more tailored agreements that can address specific trade imbalances or concerns, rather than imposing a one-size-fits-all solution.

For ordinary people, this means that the impact of tariffs may vary depending on the country involved, potentially reducing the overall economic strain that could arise from broad tariffs. It can also foster better trade relationships, as countries may be more willing to negotiate when they know the terms will be specific to their situation.

EQUITIES

European markets continued their upward momentum for the second week in a row, with the German DAX index closing 3.33% higher and the pan-European STOXX 50 rising by 3.15%.

In the U.S., stocks also experienced a largely positive week. The Nasdaq Composite surged by 2.90%, finishing just 1% shy of its all-time highs, reflecting strong investor enthusiasm, particularly for technology stocks. Similarly, the S&P 500 Index also saw gains, contributing to a broader sense of recovery in the equity markets.

Meta Platforms Inc has reached new heights, marking an impressive 20 consecutive days of gains, largely driven by strong support for its artificial intelligence initiatives. This remarkable performance has surpassed its previous record for the longest rally, which lasted 11 days back in September 2015. The current surge began on January 16, coinciding with reports that President-elect Donald Trump was considering an executive order to postpone the U.S. ban on TikTok.

This rally has been notable not only for its length but also for its resilience, as it started during the final days of the Biden administration and has continued through significant market events. These include concerns over potential chip tariffs and a widespread selloff in technology stocks triggered by the Chinese start-up DeepSeek, which raised worries about increased competition in the AI sector. Despite these challenges, Meta has been one of the few U.S. tech companies to see its stock rise amid these turbulent market conditions, highlighting investor confidence in its strategic direction and growth potential in the AI landscape.

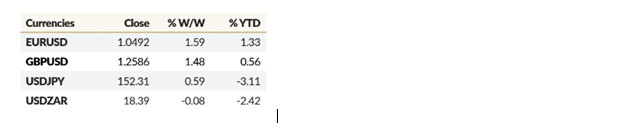

CURRENCIES

The U.S. Dollar has declined in value against most major currencies, with the most significant losses observed against the Euro, while it held steady against the Yen. This depreciation occurred despite a Consumer Price Index (CPI) reading that was higher than anticipated. The CPI is a key economic indicator that measures the average change over time in the prices paid by consumers for a basket of goods and services. It is often used to gauge inflation levels, as rising CPI values typically indicate increasing inflation.

The news regarding a delay in the implementation of trade tariffs by the U.S. President helped to ease traders’ concerns about the potential for even higher inflation in the U.S. and worldwide. This risk-on sentiment was reflected in global markets, where strong rallies in equity markets contributed to the weakening of the Dollar. However, other major currencies faced challenges in establishing clear trends against the Dollar, as most non-dollar pairs and crosses remained within their previous trading ranges throughout the week.

COMMODITIES

Gold has made headlines recently, reaching a record high of $2,964 on Friday, showcasing its appeal as a safe-haven asset amid ongoing economic uncertainties. This surge reflects investor confidence in gold as a hedge against inflation and market volatility.

Meanwhile, silver has also shown impressive performance, gaining an additional 0.90% week on week, marking its fourth consecutive week of increases. As silver approaches its highest price in over a decade, it signals a growing interest in precious metals, often seen as a complementary investment to gold.

Natural Gas futures have been another focal point, rising for the fifth straight session and achieving a remarkable 12.57% gain for the week. This upward trend can be attributed to several factors, including forecasts of colder weather, robust demand for liquefied natural gas (LNG), and tightening storage levels, which have all contributed to pushing prices higher. Notably, LNG exports have reached record highs, underscoring the strong global demand for this energy source.

However, the market is also keeping a close eye on geopolitical developments, particularly regarding the Russia-Ukraine conflict. There is a growing expectation that a resolution could lead to the full re-entry of Russian gas supplies into the market, which may temper price expectations for natural gas moving forward.

On the agricultural side, coffee prices have been on an upward trajectory, with arabica coffee prices doubling over the past year. This significant increase is largely driven by climate change-related weather patterns that have disrupted agricultural production worldwide.

The implications of the rising arabica coffee prices are significant. Firstly, farmers may experience increased income, which could lead to greater investment in sustainable farming practices and improved quality of coffee. This could also encourage more farmers to enter the coffee market, potentially increasing competition. On the consumer side, higher prices could lead to increased costs for coffee products, impacting consumers’ purchasing decisions and potentially altering consumption patterns. Additionally, this shift could have broader economic effects, influencing trade balances in coffee-exporting countries and affecting global coffee supply chains.