Stock markets began the week on a downward trend after President Donald Trump announced a significant policy shift, stating that the U.S. would impose a 25% tariff on imports from Mexico and Canada, alongside a 10% tariff on imports from China.

However, by the end of Monday, the tariffs on Mexico and Canada were postponed to allow for further negotiations aimed at reaching a more sustainable agreement. This temporary reprieve, combined with strong earnings growth from U.S. companies, helped the markets recover some of their initial losses as the week progressed.

Trump’s implementation of the 25% tariffs on imports from Mexico and Canada was driven by his administration’s ongoing efforts to protect American jobs and industries. He emphasized, “We must protect our workers and our industries,” highlighting the administration’s stance on prioritizing domestic production over foreign imports. This tariff strategy is expected to reshape America’s business landscape by increasing production costs for companies reliant on imported goods, potentially leading to higher prices for consumers.

For Mexico and Canada, the tariffs could negatively impact their economies, particularly in sectors like manufacturing and agriculture, which are heavily intertwined with U.S. markets. The potential economic slowdown could lead to a decrease in GDP growth for both nations, as they navigate the implications of reduced exports to the U.S. market.

On the other hand, the 10% tariff on Chinese imports adds another layer to the ongoing trade conflict between the U.S. and China. This conflict centers on issues such as intellectual property theft and trade imbalances. The tariff is likely to impact both economies; for the U.S., it may lead to increased costs for consumers and businesses that rely on Chinese goods. For China, the tariffs could hinder its ambitions to become the leading global producer and exporter of goods, as they may face decreased demand from one of their largest markets.

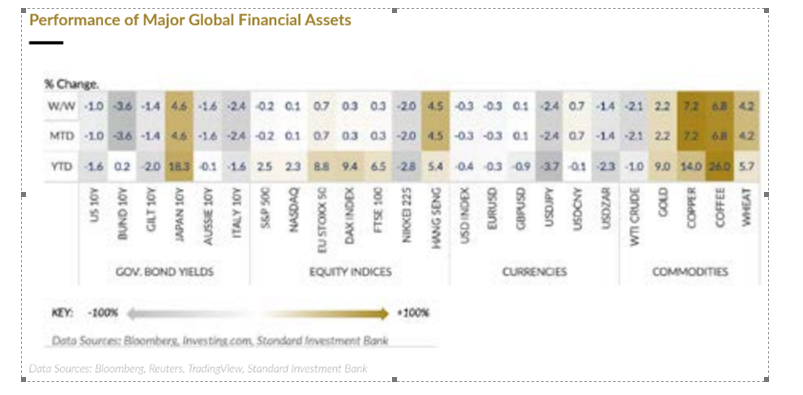

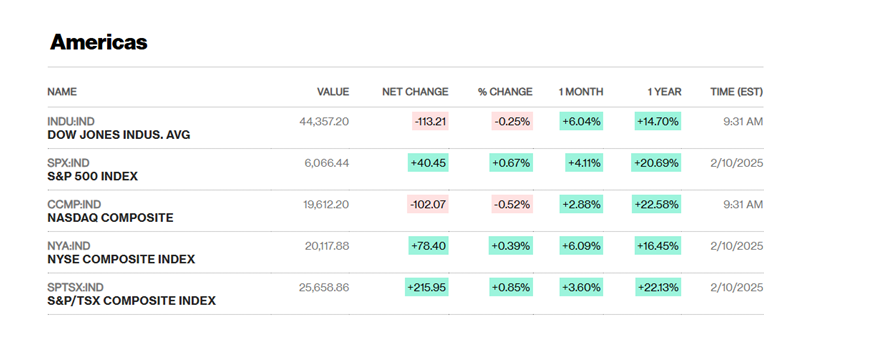

Equities saw notable fluctuations as the S&P 500 Index and the Dow Jones Industrial Average closed the week marginally lower amidst a whirlwind of market-moving headlines. The tech-heavy Nasdaq managed to secure a slight gain of just under a tenth of a percent, but the week was marked by significant volatility driven by several key companies.

In particular, shares of major technology firms like Apple and Amazon exhibited notable swings due to concerns over supply chain disruptions and regulatory scrutiny. Additionally, Tesla’s stock faced pressure after a mixed earnings report, which contributed to the overall market uncertainty. Financial institutions like JPMorgan Chase and Goldman Sachs also played a role, as their quarterly results sparked discussions about the economic outlook and interest rates, further adding to the volatility.

The tech-heavy Nasdaq managed to secure a slight gain of just under a tenth of a percent, despite the overall volatility in the markets. This performance was largely influenced by the resilience of major tech companies like Microsoft and Alphabet, which reported better-than-expected earnings, helping to bolster investor sentiment. However, other tech stocks, such as Facebook and Netflix, experienced declines due to concerns over user growth and increased competition. The mixed results from these companies contributed to the Nasdaq’s modest gain, highlighting the contrasting trends within the tech sector during a week filled with significant market activity.

EUROPE

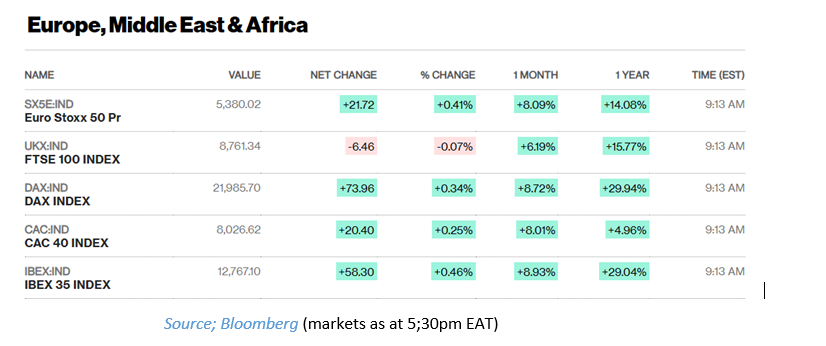

Stocks in Europe traded largely higher, as reflected by the EU 50 and German DAX indices, primarily due to positive economic data and corporate earnings reports that exceeded expectations. Strong performances from key sectors, particularly technology and consumer goods, fueled investor optimism.

Specific stocks that contributed to this upward trend included Siemens, which reported robust quarterly earnings, and SAP, benefiting from increased demand for its software solutions. Additionally, luxury goods companies like LVMH saw gains as consumer spending in Europe remained resilient, further boosting market sentiment across the region. Overall, the combination of encouraging economic signals and strong corporate results drove the positive performance in European equities.

Source; Bloomberg (markets as at 5;30pm EAT)

MIDDLE EAST

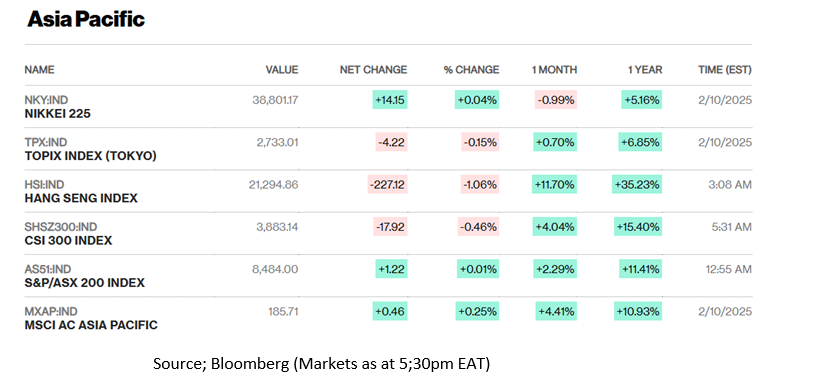

Japanese stocks tumbled over 1.5% as traders sought safety in response to rising expectations of interest rate hikes by the Bank of Japan (BoJ). The sell-off was triggered by speculation that the BoJ might shift its monetary policy stance amidst increasing inflationary pressures and a strengthening economy.

Source; Bloomberg (Markets as at 5;30pm EAT)

Market analysts have been closely monitoring the BoJ’s comments and economic indicators, leading to heightened expectations that the central bank may soon begin to raise interest rates from their historically low levels. This potential shift is seen as a response to the need to manage inflation, which has been creeping up due to global supply chain issues and rising commodity prices.

As traders reacted to these developments, they moved away from equities and sought safer investments, such as government bonds and cash. This flight to safety reflected concerns about the impact of higher borrowing costs on corporate profits and economic growth, leading to the significant decline in Japanese stock prices.

Uber Technologies Inc. rallied over 11%, making it our stock of the week following its latest earnings report, which showed that revenues and gross bookings exceeded estimates. On the company’s earnings call, CEO Dara Khosrowshahi acknowledged that while Uber continues to achieve solid growth and margin expansion, there are notable currency risks, particularly concerning operations in Argentina, Mexico, and Brazil—three of the top 20 countries where Uber operates.

Uber is listed on the New York Stock Exchange (NYSE) under the ticker symbol UBER. The currency risks mentioned by Khosrowshahi arise from the potential volatility in exchange rates that could affect the company’s revenues when converting local earnings back to U.S. dollars. While the top line may experience some impact due to these fluctuations, the bottom line is somewhat insulated because drivers and merchants are paid in local currencies, creating a natural hedge against currency risk. This means that while Uber may face challenges in revenue reporting due to currency changes, its operational costs remain stable, helping to protect overall profitability.

The CEO confirmed the company’s commitment to Autonomous Vehicles and positioned Uber as the indispensable go-to-market partner for autonomous players through aggressive investments. This announcement prompted many analysts to maintain a Buy rating on the stock, with the majority raising their price targets. This positive outlook was reinforced on Friday when prominent investor Bill Ackman, founder of Pershing Square Capital Management stated, “We believe that Uber is one of the best managed and highest quality businesses in the world.”

COMMODITIES

Silver, Gold, and Copper all performed well over the week, with gains of 1.63%, 2.24%, and 7.24%, respectively. Natural Gas experienced a significant increase of 8.71% for the week, largely due to China’s announcement of retaliatory tariffs of 15% on its Natural Gas exports to the U.S.

This surge in Natural Gas prices can be attributed to the market’s reaction to geopolitical tensions and trade disputes between the U.S. and China. The imposition of tariffs typically raises costs for importers, which can lead to supply concerns and push prices higher. As China imposed tariffs on its exports, traders anticipated a potential decrease in the availability of Natural Gas in the U.S. market, driving prices up as demand remained steady or increased.

Oil prices fell by 2.11%, marking the third consecutive week of declines. This downward trend in oil prices can be attributed to various factors, including oversupply concerns, changes in demand, or geopolitical issues affecting production.

In contrast, several agricultural commodities experienced gains, with Wheat rising by 4.16%, Corn by 1.14%, Sugar by 0.72%, and Coffee by 7.01%. These increases could be influenced by factors such as weather conditions, harvest yields, or shifts in consumer demand.

On the flip side, Cocoa prices dropped for the second week in a row, losing 8.82%. This decline is primarily due to slowing demand for cocoa as high prices compel chocolate manufacturers to alter their recipes, often substituting cocoa with other ingredients to manage costs.