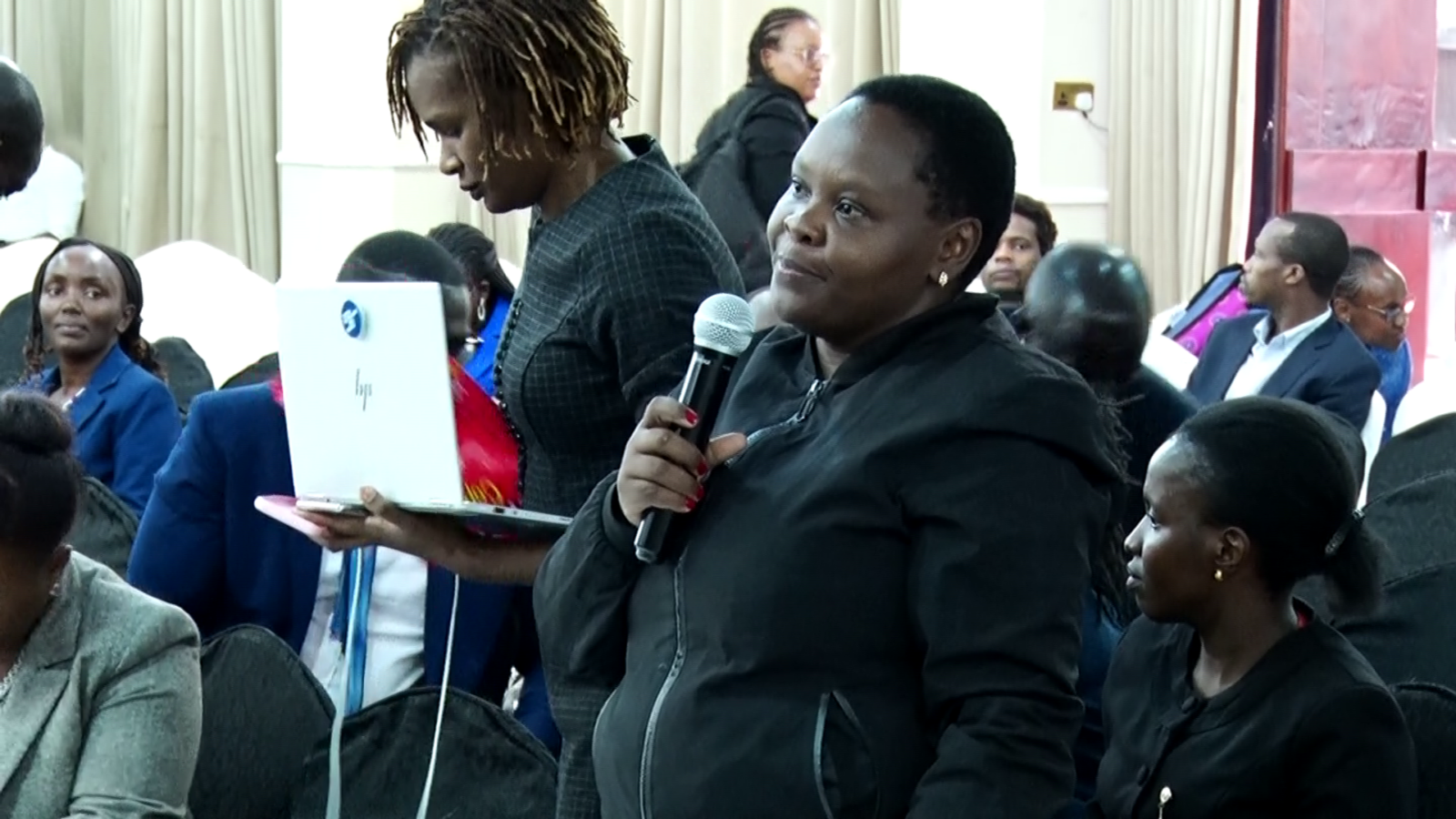

Kenya can raise an additional revenue of KSh60 billion annually by targeting individuals who abscond child support duties, this is according to a lady who made her submissions on the Tax Laws Amendment Bill, 2024.

The lady, who identified herself as Veronica, proposed to amend the existing laws to give powers to the Kenya Revenue Authority to collect KSh1,000 out of a designated proposal of KSh3,000 processing fee of cases involving child support.

Veronica told members of the National Assembly Committee on Finance and National Planning that due to the prevalent cases of individuals absconding their parental roles, child support related cases could be as high as 20 million, thus a perfect avenue for the country to collect revenue close to a tune of KSh60 billion annually.

She further proposed that after KRA takes its share of KSh1,000, the remaining KSh2,000 should be channeled to the National Police Service (NPS) to be used to establish safe houses for victims of gender based violence.

“And trust me, this would even go beyond the 20 million child support cases that I am targeting annually,” she said, amid laughter from the audience.

In order to kill two birds with one stone, Veronica added: “We need to expand our tax base not to go deeper but to go wider. How do you go wider? She paused. “By implementing laws that are already there. If someone has a pay slip and he is absconding child support, at least KSh5,000 should be deducted monthly.”

Public participation

Veronica is among the hundreds of Kenyans appearing before the Molo MP Kuria Kimani-led committee, which is taking views of Kenyans on the Bill.

While making its submissions, telco giant Safaricom PLC proposed to the Committee to consider retaining the rate of Excise Duty on fees charged on telephone and internet data services at 15%.

Maintaining the excise duty rate at 15 %, Safaricom PLC says, will promote the industry’s stability and predictability efforts, promote inclusivity, and foster increased uptake of online jobs thus increasing employment opportunities.

Kenya Association of Manufacturers (KAM) proposed the establishment of a Tax Refund Fund ring-fenced to specifically cater for all refunds. KAM argues that a tax refund should not be considered as government revenue and reimbursed upon confirmation of the same.

KAM further argued that payment of refunds in Kenya has faced a lot of delays and affected the liquidity of businesses, especially for manufacturers. The delays have been attributed to the process of reversing back the money once it has been paid into the national consolidated fund.

On their part, the Law Society of Kenya urged the Committee to define a threshold for Significant Economic Presence Tax to clarify on how Significant Economic Presence is established. LSK recommended a threshold based on quantum, in addition to the user-based definition to avoid creating a catch-all mechanism.

Kenyans have until Thursday, November 28 to submit their views before the Committee.