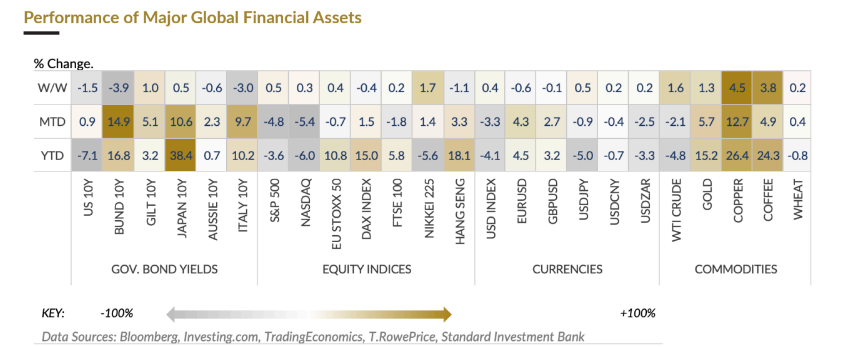

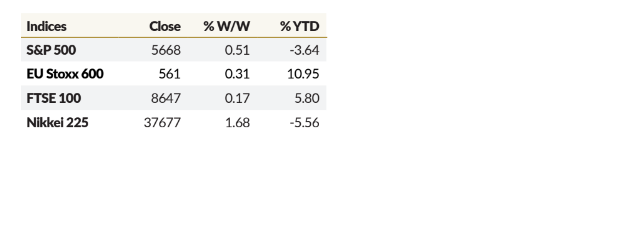

Wall Street caught a break on Friday as US stocks finally broke a four-week losing streak. The major US indices closed in positive territory, with the S&P 500 gaining 0.51% and the tech-heavy Nasdaq Composite adding 0.25%. This rebound was fueled by a combination of factors, including a dovish stance from the Federal Reserve. The Fed held its policy rate steady at 4.25%-4.5% and maintained its forecast of 50 basis points of rate cuts this year. The Fed Chair emphasized that they expect the inflationary impact of these cuts to be temporary, with longer-term inflation remaining anchored at their 2% target. The tech sector, which had been particularly hard-hit during the recent downturn, played a key role in the market’s recovery. Large-cap tech stocks, including Apple, Microsoft, and Amazon, saw significant gains, boosting the Nasdaq Composite.

While US stocks celebrated a much-needed bounce back, Europe’s markets were a bit more cautious. The pan-European STOXX 600 index ended the week 0.31% higher, but sentiment was somewhat subdued due to looming uncertainty over US tariffs scheduled for early April. The threat of these tariffs, aimed at European goods, has injected a dose of anxiety into the market. Investors are concerned about the potential impact on trade flows and economic growth, particularly given the already fragile state of the global economy. Adding to the cautious mood is the ongoing uncertainty surrounding growth and inflation in the Eurozone. Key central banks in the region have adopted a wait-and-see approach to their policy actions, preferring to monitor the situation closely before making any significant moves. This reluctance to act decisively reflects the delicate balancing act they face, trying to stimulate growth without fueling inflation. While the STOXX 600 managed a modest gain, the overall market mood remains fragile.

It wasn’t all sunshine and rainbows in Asia this week. Despite a string of positive economic indicators, Mainland Chinese stocks markets reversed course, ending a two-week winning streak. The good news was that the Chinese economy started the year on a solid footing. Several key indicators, like industrial production and retail sales, came in stronger than expected, suggesting that the Chinese economy is holding up well despite global headwinds. This strong performance prompted several analysts to revise their forecasts for China’s GDP growth upwards. They are now more confident that Beijing can achieve its ambitious annual growth targets, even with the looming threat of an escalating trade war with the US. However, the stock market’s reaction was more muted. Investors remain wary of the ongoing trade tensions and their potential impact on the Chinese economy. The fear is that a full-blown trade war could disrupt global supply chains, hurt Chinese exports, and ultimately dampen economic growth.

YIELDS

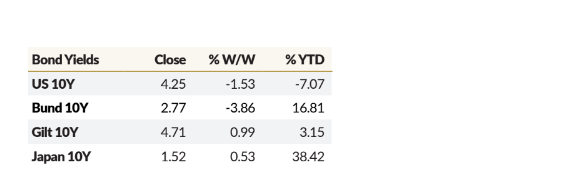

In the US treasuries, there were mixed signals. The good news is that Treasury yields, which move inversely to prices, declined across most maturities, leading to positive returns for bondholders. This was partly driven by the Federal Reserve’s recent policy meeting, where they signaled a cautious approach to future rate hikes, suggesting that they’re not in a hurry to tighten monetary policy. However, the market remained on edge, with the 10-year Treasury yield taking a slight dip after President Trump hinted at imposing tariffs on European goods. This uncertainty about the future of trade policy, with the April 2nd deadline for reciprocal tariffs looming, has investors on pins and needles. The spread between the 2-year and 10-year Treasury yields, a key indicator of the yield curve, remained largely unchanged at 30 basis points. This suggests that investors aren’t overly concerned about an immediate recession, but the potential impact of tariffs on economic growth is a cause for concern.

Across the pond, central banks were taking different approaches to managing their economies. The Bank of England kept interest rates unchanged at 4.5%, a decision that was widely anticipated by market watchers. This means that borrowing costs for businesses and individuals in the UK will remain at their current level. Meanwhile, the Swiss National Bank took a more decisive step, lowering its policy rate by 25 basis points. This move was driven by concerns about low inflation and a growing number of economic headwinds. The Swiss economy, known for its export-driven nature, is particularly vulnerable to global economic shocks. So, what are these “downside risks” that the Swiss National Bank is worried about? Well, they could include things like a slowdown in global demand for Swiss goods, a sharp decline in the value of the Swiss franc, or a renewed escalation of the trade war between the US and China.

EQUITIES

The stock market experienced a rollercoaster ride on Friday, as highlighted by Dan Murage, portfolio analyst – global markets, at Standard Investment Bank with major U.S. indices initially dipping into negative territory before rebounding to close in the green. This shift in sentiment was fueled by President Trump’s suggestion of potential “flexibility” on tariffs, offering a glimmer of hope for a resolution to the ongoing trade tensions. Additionally, several mega-cap stocks, those with large market capitalizations, staged a comeback, further bolstering the market’s overall performance.

While U.S. markets were experiencing a rebound, the German stock market took a different path, with the DAX index closing the week down 2.53% from its all-time highs. This decline, which saw the DAX settle at 22,888 points on Friday, suggests that the German economy may be facing headwinds that are not yet reflected in the U.S. market.

BYD, the Chinese electric vehicle (EV) giant, unveiled a brand new fast-charging technology that’s going to shake things up in the EV world. BYD says this revolutionary technology will be available on their new car models, which are hitting the market next month. The news sent BYD’s stock soaring to all-time highs, with its value up a whopping 33% this year. That’s a massive contrast to their main competitor, Tesla, which has been struggling lately, losing half its value since December. This is a big deal for BYD and a potential wake-up call for Tesla. It shows that BYD is really pushing the boundaries of EV technology, and it could give them a significant advantage in the market. For Tesla, this is a clear sign that they need to step up their game. They’ve been known for their innovation, but BYD’s new technology is showing that they’re not the only ones pushing the limits. If Tesla doesn’t come up with something equally impressive, they could be left behind in the race for EV dominance. So, what does this mean for you, the average car buyer? Well, it could mean faster charging times, more convenient electric vehicles, and potentially even lower prices as the competition heats up. It’s an exciting time for the EV market, and BYD’s new technology is just the latest chapter in this fast-evolving story.

CURRENCIES

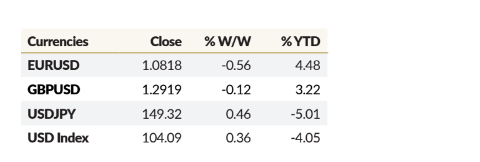

The US dollar is holding its ground, hovering above 104, but it’s a tense situation. Investors are waiting to see what President Trump will do about trade policies, which could have a big impact on the economy. The dollar has been struggling this year because of tariffs, which hurt growth. However, the dollar got a boost when the Federal Reserve (the US central bank) said they’re not in a hurry to cut interest rates, which makes the dollar more attractive to investors. Against other currencies, the dollar is holding its own against the Euro, British pound, and New Zealand dollar, Kiwi. But it’s gaining strength against the Japanese Yen and the Chinese Yuan.

The Turkish Lira has plummeted to record lows, breaking the 39 per USD mark, reflecting a deepening economic crisis fueled by political turmoil. This dramatic decline comes amidst heightened tensions surrounding the arrest and sentencing of Istanbul’s Mayor, Ekrem Imamoglu, a prominent opposition figure and a potential challenger to President Recep Tayyip Erdogan.

The Lira’s sharp depreciation is a direct consequence of this political instability and its impact on investor confidence. The arrest of Imamoglu has heightened concerns about the erosion of democratic principles and the rule of law in Turkey, discouraging foreign investment and fueling capital flight. Additionally, Turkey’s high inflation rate, exacerbated by the ongoing economic crisis, further weakens the Lira and creates a vicious cycle of rising prices and declining purchasing power. The Turkish Central Bank’s policies, perceived by some as ineffective in curbing inflation, have also contributed to the Lira’s downward spiral.

COMMODITIES

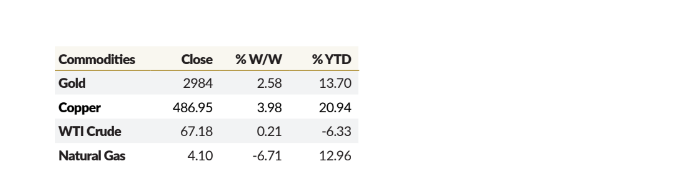

Oil prices are on the rise, driven by a perfect storm of geopolitical tension and supply constraints. WTI crude futures closed the week at $68.3 per barrel, marking their second consecutive weekly gain, with a 1.64% increase. This upward trend is fueled by a combination of factors. Firstly, new US sanctions on Iran are expected to significantly reduce Iranian oil exports by a million barrels per day. Secondly, OPEC+, a coalition of oil-producing nations, is planning to cut production, further tightening supply. This strategy is similar to the 2016-2018 period when OPEC+ coordinated production cuts to stabilize prices.

In a parallel development, copper futures surged towards the $5.1 per pound mark on Friday, testing record-high levels. The market is bracing for potential tariffs on copper imports, a move that could significantly impact domestic smelter capacity. President Trump’s executive order initiating a review on copper imports follows his earlier threat to impose tariffs on the metal during a congressional address. This situation mirrors the steel and aluminum tariffs imposed in 2018, which led to a surge in prices for those metals. Meanwhile, natural gas futures ended the week under pressure, closing lower. Traders are grappling with a bearish combination of factors, including weak early-season demand, a surprise storage injection, and ongoing mild weather.