Kenya Power has reported a net profit of Sh319 million for the six months ending December 2023, marking a notable recovery from the Sh1.15 billion net loss in the same period the previous year.

The utility firm attributes this reversal to a surge in electricity sales and a tariff hike.

The not reviewed results, released on Friday, reveal a 31.3 percent increase in revenue from electricity sales, reaching Sh113.55 billion.

During this period, Kenya Power connected 225,000 new customers to the grid, surpassing its target by 13.87 percent.

Tariff Review and Operational Efficiency

The improved profitability results from increased electricity sales, a cost-reflective tariff review in April 2023, and a 129GWh increase in unit sales, contributing to higher revenue.

Kenya Power adjusted the base consumption charge to Sh12.22 per unit for lifeline consumers, up from Sh10, and revised the lifeline threshold last year.

Households with monthly consumption between 31kWh and 100kWh experienced a 19 percent tariff increase.

Despite operating costs rising 9.4 percent to Sh19.7 billion, Kenya Power’s operating profit rose 2.6 times to Sh14.45 billion.

Read Also: Robert Alai condemns attack on Nairobi City askaris

However, a doubling of finance costs, rising from Sh7.39 billion to Sh15 billion, tempered the surge in earnings.

The increase results from unrealized foreign exchange losses due to the shilling depreciating against major currencies.

Mitigating Forex Exposure and Restructuring Efforts

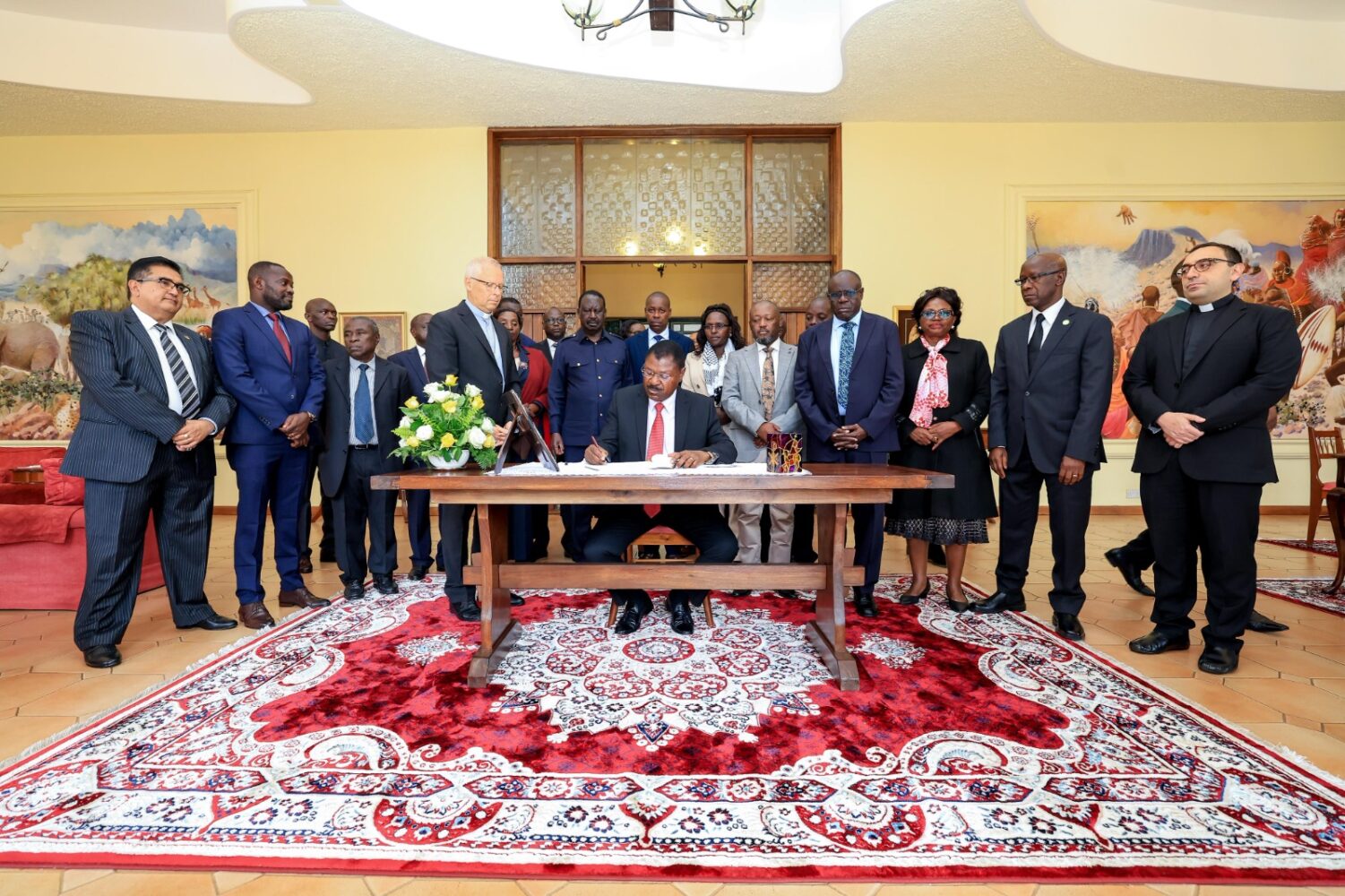

Kenya Power Managing Director, Joseph Siror, expressed optimism about the recent strengthening of the shilling, hoping it will cut forex losses and reduce spending on thermal power purchases.

Despite Kenya Power’s negative working capital position, restructuring supported by tariff adjustments aims to reduce dependence on exchequer support and address the imbalance between current liabilities and assets.

The National Treasury anticipates that these measures will enhance the utility firm’s financial stability in the long run.