Liquidity

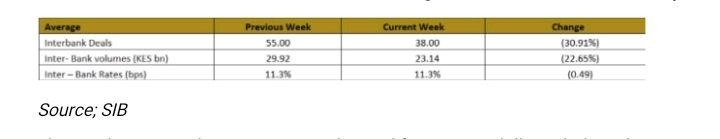

Liquidity conditions in the money market remained notably stable over the past week, with the average lending rate maintaining a steady 11.31%, unchanged from the previous week.

However, interbank trading activity experienced a decline, with transaction volumes dropping by 22.6% to KES 23.14 billion, down from KES 29.92 billion. This decrease was accompanied by a 30.91% reduction in the number of transactions, indicating a moderation in market activity.

This week witnessed a resurgence in demand for Treasury bills, with the subscription rate soaring to an impressive 136.7%, a significant increase from the previous week’s 78.6%.

The 91-day Treasury bill emerged as the standout performer, attracting the highest interest both in absolute terms and relative to its subscription rate. This surge underscores the ongoing strategies employed by investors to manage short-term liquidity effectively.

Total bids reached KES 32.82 billion, and in a show of confidence, the fiscal agent accepted all submissions, reflecting a healthy appetite for government securities amidst evolving market conditions.

Infrastructure bonds

In the primary bond market, the fiscal agent is aiming to raise KES 70 billion through the reopening of two infrastructure bonds: IFB1/2022/14 and IFB1/2023/17. These bonds have effective tenors of 11.8 years and 15.1 years, respectively.

Notably, these instruments are structured as amortized bonds, meaning that they will pay back both principal and interest over the life of the bond rather than a lump sum at maturity.

Approximately half of the outstanding amounts for the 2022 issuance will mature in about six years, while the 2023 issuance will see similar repayment in approximately eight years. This approach allows investors to recoup a portion of their investment earlier, making these bonds attractive for those seeking steady cash flows.

The amortization feature can also reduce the refinancing risk for the issuer, as it ensures that a portion of the debt is paid down over time rather than all at once at maturity.

Domestic borrowing

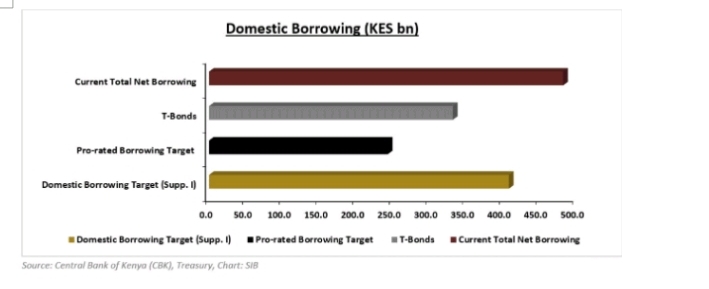

The government is currently outperforming its domestic borrowing targets for the fiscal year 2024/25, having successfully raised KES 482.36 billion, which is 18.1% above the set target of KES 408.41 billion.

Excluding Treasury bills from the equation, domestic borrowing surpasses the prorated target by an impressive 36.4%, currently accounting for 81.3% of the overall borrowing goal. This robust performance underscores the government’s effective strategy in mobilizing domestic resources to support its fiscal objectives.

Foreign exchange and reserves

In the foreign exchange market, the Kenyan shilling exhibited mixed performance across the monitored currency pairs. The most significant depreciation occurred against the Euro, while the shilling made notable gains against the Japanese Yen, reversing losses from the previous week. It appreciated by 0.2%, closing at a 7-week high against the US dollar, although it remains around the KES 129-130 resistance level. This movement aligns with a 0.8% weakening of the USD Index.

Kenya’s foreign exchange reserves have decreased by 5.4%, now totaling USD 8.65 billion, which provides 4.4 months of import cover. This is a decline from USD 9.14 billion, which offered 4.7 months of import cover the previous week. The reduction in reserves is likely linked to external loan interest payments, particularly those owed to China, which are generally due in January and July. This situation highlights the impact of debt servicing on the country’s foreign reserves and its ability to cover imports.

Moody’s ratings

In its January review, Moody’s affirmed Kenya’s local and foreign-currency long-term issuer ratings, as well as its foreign-currency senior unsecured debt ratings at Caa1.

In a positive development, Moody’s upgraded its outlook from negative to positive. This contrasts with other major rating agencies, which revised their outlooks to stable, although the prevailing market conditions, particularly regarding borrowing costs, may have justified their positions.

The Caa1 rating places Kenya in the speculative category, signifying a considerable level of credit risk. This rating underscores concerns related to weak debt affordability and the country’s substantial financing needs.

Moody’s points out that several factors contribute to this risk, including the presence of weak institutions, unpredictable policy environments, and elevated corruption levels. These issues hinder the effectiveness of fiscal policy and impede efficient revenue collection, ultimately affecting the government’s ability to manage its debt sustainably.

Despite these challenges, Moody’s acknowledges that Kenya has a relatively developed domestic capital and credit market, which offers some degree of resilience. This infrastructure allows for better access to financing and investment opportunities, potentially mitigating some of the adverse effects of the country’s credit risks.

However, the ongoing issues with governance and fiscal stability remain critical hurdles that need to be addressed to improve the overall economic outlook and enhance investor confidence in Kenya’s financial landscape.

This marks the first time since 2007 that the rating agency has assigned a positive outlook to Kenya, suggesting either a recovery from a very low or extremely unfavorable position, or indicating that structural monetary and fiscal adjustments are expected or have already been implemented.

However, this assessment offers a nuanced view of Kenya’s creditworthiness, carefully weighing the risks posed by weak governance and high financing needs against the opportunities arising from stronger economic growth and ongoing fiscal reforms.

Below are the key factors that led to the revision of the outlook to positive:

1. Declining Borrowing Costs and Expectations of Further Decline: Moody’s noted that lower borrowing costs are beneficial for the government’s fiscal position, allowing for more sustainable debt management. The expectation of continued declines in these costs further supports economic stability.

2. Fiscal Consolidation Goals: According to Moody’s, the government’s commitment to fiscal consolidation is crucial. This involves reducing deficits and managing public finances more effectively, which can enhance investor confidence.

3. Potential Improved Access to External Funding: Moody’s highlighted that a positive outlook could lead to better access to international funding sources. This improved access is vital for financing development projects and managing existing debt.

4. Availability of Reserves: Moody’s emphasized the importance of maintaining adequate foreign exchange reserves. A solid reserve position can help stabilize the economy and provide a cushion against external shocks.

5. Expectations of a Revenue Boost: Moody’s pointed out that anticipated revenue increases, whether from improved tax collection or economic growth, could significantly strengthen the government’s financial position, reducing reliance on external borrowing.