The market wrapped up the day exhibiting a mixed performance showcasing the dynamic nature of investor sentiment as the NSE 25 recorded gains of 0.3% to close at 3569.73 points. In contrast, the NASI and NSE 20 indices exhibited relative stability each closing at 132.48 and 2185.88 points respectively.

Foreign investors dominated market activity, accounting for 61.6% of the turnover levels, down from 64.6% yesterday, a decline of 3%. Equity turnover declined to 3.4m.

Market movers

Safaricom was the top traded counter, at 35.7% of the day’s market activity. The stock gravitated to a position of relative stability remaining unchanged at KES 18.90 for the third session. Of the traded banking stocks, KCB group gained 1.0% to close at ksh 45.80. Stanchart gained 0.5% to close at ksh 286.50. I&M Bank remained unchanged at ksh 34.90. EABL gained 2.0% to ksh 193.25 ahead of its 1H25 results expected on Friday next week.

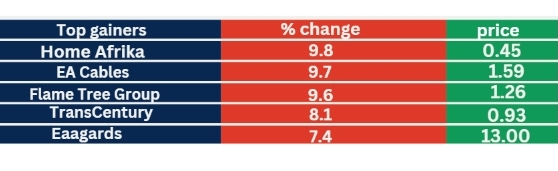

Market gainers

In the gainers chart, Home Afrika topped the chart up 9.8% to close at ksh 0.45 thwarting EA Cables that led the gainers chart yesterday but followed closely at 9.7% to close at ksh 1.59. Flame Tree Group and Transcentury gained 9.6% and 8.1% to close at ksh 1.29 and 0.93 respectively. Eaagards rounded up the top five gainers, up 7.4% to close at ksh 13.00.

Market losers

In the losers chart, HF Group topped Kenya Airways’ retreat shedding 9.6% to close at ksh 8.12 as Kenya Airways remained largely unchanged, shedding 4.3% to close at 5.36. Liberty Holdings and Centum shed 3.8% and 3.4% to close at ksh 7.10 and ksh 11.45 respectively. Total Kenya rounded up the losers chart down 2.9% to close at ksh 21.85.

Markets may be closed, but futures never sleep! It appears that promising opportunities lie ahead for those eyeing investments in banking stocks.

“Currently, investors should seriously consider banking stocks as we approach earnings season, which often brings dividends,” Edwin Wanjohi, equity dealer at sterling capital limited said during an interview.

This period is anything but dull, as the potential for growth and returns becomes increasingly tangible. Earnings season refers to the time when publicly traded companies release their quarterly financial results.

This is a crucial period for investors, as it provides insights into a company’s performance, profitability, and future outlook. Strong earnings reports can lead to increased stock prices, while disappointing results may have the opposite effect.Dividends, on the other hand, are payments made by companies to their shareholders, typically derived from profits. They represent a way for companies to share their success with investors.

For those investing in banking stocks, dividends can provide a steady income stream, making these investments particularly attractive during earnings season when many banks announce their dividend payouts alongside their earnings reports.