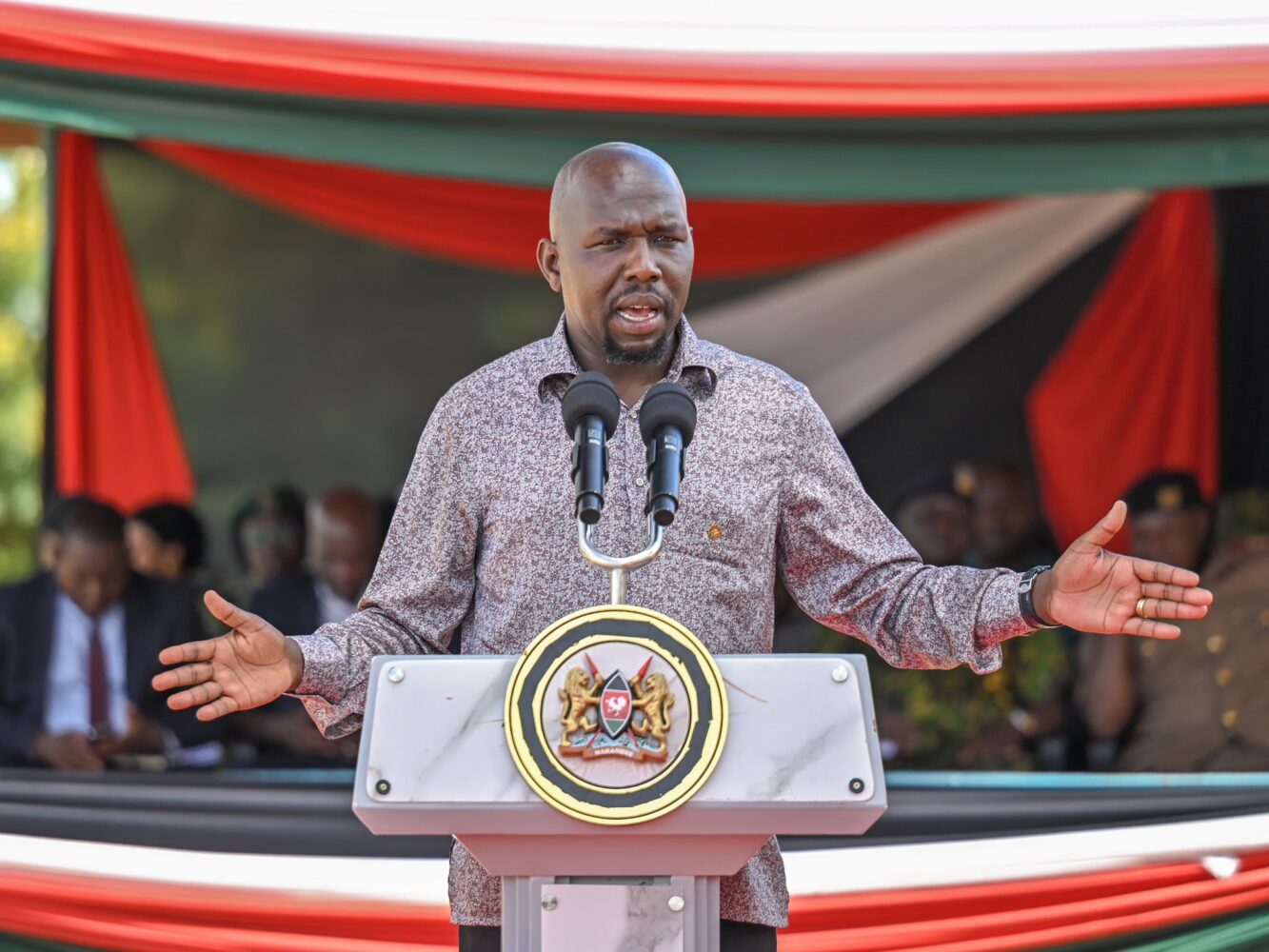

The National Assembly’s Committee on Communication, Information, and Innovation, led by Hon. John Kiarie, put the Director-General of the Communications Authority (CA), Mr. David Mugonyi, on the spot over a new initiative aimed at enhancing the integrity and tax compliance of mobile devices in Kenya.

The committee demanded clarity on the proposed system’s implications for privacy, data protection, and its enforcement mechanisms, especially given concerns about personal data potentially falling into the wrong hands.

Hon. Kiarie had concerns regarding Kenya’s existing privacy laws and their sufficiency in protecting citizens’ data. “The issue isn’t with registering IMEIs. What exactly are we allowing KRA to access on an individual’s phone under the guise of data protection?” he asked pointedly. Kiarie highlighted the potential risk that Kenyans could avoid online transactions for fear of increased surveillance. “What can we say to Kenyans who may flee from digital transactions to avoid scrutiny? We must ensure their data remains protected.”

Hon. Geoffrey Wandeto raised critical questions about the CA’s ability to monitor and enforce compliance across all communication devices entering the country so that we dont have a repeat of the Worldcoin. “What are your enforcement capabilities when it comes to all communication devices being imported?” he asked, emphasizing the need for strong regulatory mechanisms to ensure that non-compliant devices are identified and addressed appropriately.

In response, Director-General Mr. Mugonyi explained that the CA had received a presidential directive to implement the system, which focuses solely on device integrity and tax compliance rather than individual transaction monitoring. “This engagement has nothing to do with the transactions we carry out on our phones,” he clarified, adding, “We want to ensure the right products are in the country, and the tax compliance aspect is strictly for that. KRA will not have access to people’s data.”

The system, Mr. Mugonyi noted, is designed to send a notification to users who activate a new device without having paid applicable taxes. The unregistered device’s IMEI will then be placed on a blacklist, preventing it from connecting to any local network until taxes are settled.

Hon. Wandeto also raised concerns about how the system would affect expatriates and visitors, arguing that people’s mobility should not be hindered. “How will this impact expatriates or people coming back for short visits? We need to allow for mobility of people and their devices,” he urged.

Mr. Mugonyi assured the committee that tourists and diplomats would have a grace period, where their devices would be placed on a temporary “greylist” to allow usage without immediate tax obligations. “This greylisting period will be formalized through public participation to ensure transparency and understanding,” he stated.

Principal Secretary for Broadcasting, Mr. Edward Kisiangani, acknowledged the potential for international tax overlap, suggesting a need for data-sharing agreements with friendly countries. “What if that phone already has tax implications from another country? We need to explore data-sharing partnerships to avoid double taxation on imported devices,” he proposed.

The CA recently issued a public notice on October 24, 2024, detailing the system’s rollout, scheduled to take effect after October 31, 2024. The system will require importers and local manufacturers to register the IMEI of mobile devices they bring into Kenya, ensuring all applicable taxes are paid before a device is activated on a local network.

Mr. Mugonyi clarified that mobile devices registered on Kenyan networks before October 31 will be exempt from further compliance checks, reassuring current users that they will not face disruptions. “The system is only targeting new mobile devices that will connect to local networks for the first time post-October 31. Previously registered devices will be considered tax compliant,” he stated.

However, any device that does not meet the compliance standards will be greylisted, with a standard grace period for the owner to settle outstanding taxes.

While the CA seeks to uphold device integrity and ensure tax compliance, the ICT Committee, led by Hon. Kiarie, remains vigilant about protecting Kenyan citizens’ data privacy. “We must strike a balance,” Hon. Kiarie concluded, underscoring that while enhancing tax compliance is essential, it should not come at the cost of privacy and public trust.