The Nairobi Securities Exchange Plc (NSE) and the Central Depository and Settlement Corporation (CDSC) marked a significant milestone, as they rang the bell to commemorate the immobilization of shares at the NSE, with the percentage of immobilized shares rising from 50% in January 2024 to 79% in April 2025.

The bell-ringing event recognized key contributors to this achievement, including the Government of Kenya through the National Treasury, which facilitated the immobilization of shares in 11 public companies, and Standard Chartered Bank (KE) investors, who successfully immobilized their shares previously held in certificate form.

This ongoing shift from physical certificates to electronic records underscores the commitment to innovation and adaptation in the ever-evolving financial landscape. Immobilization has been instrumental in streamlining trading processes, laying the foundation for a more dynamic, liquid, and globally connected market.

It is a key step toward enhancing market efficiency, security, and transparency, setting the stage for the continued growth and modernization of Kenya’s financial ecosystem.

Since the dematerialization of the stock market in 2012, physical share certificates have been replaced by secure electronic records maintained in the Central Depository System (CDS) by the CDSC.

The NSE and CDSC have actively engaged with investors to encourage the conversion of physical certificates to electronic shares, ensuring that investors can seamlessly trade on the NSE. Shares held in certificate form cannot be sold or transferred, making this transition critical for market participation.

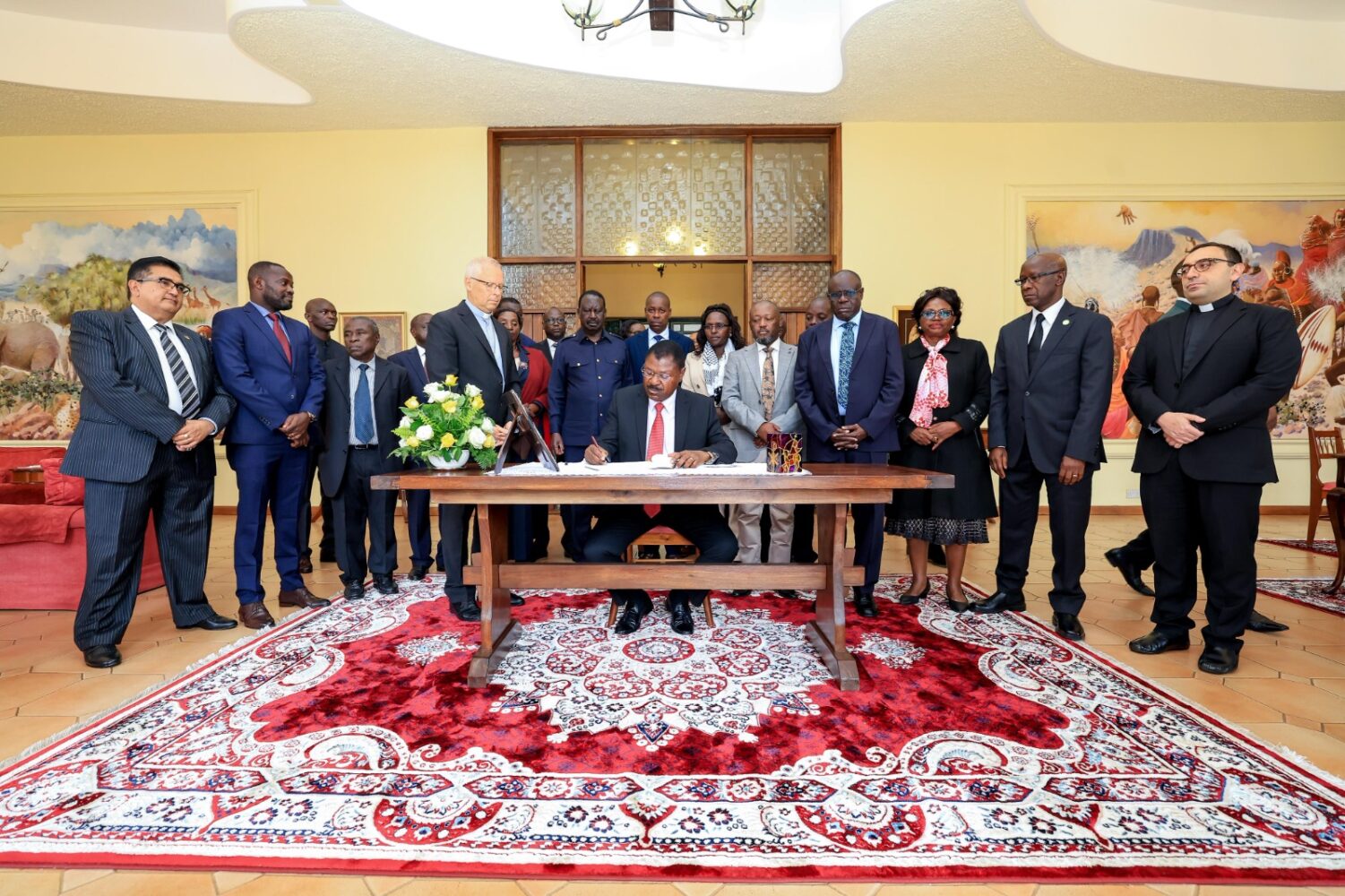

Speaking at the event, Mr. Kiprono Kittony, Chairman of the NSE, emphasized that share immobilization marks a transformative step for the capital markets.

CDSC Chief Executive, Jesse Kagoma, emphasized the importance of full dematerialization in enhancing market efficiency, safeguarding investor assets, and boosting liquidity.

“This achievement is a testament to the collective commitment of our market stakeholders in advancing Kenya’s capital markets,” said Kagoma.

“We encourage all investors still holding physical share certificates to work with their registrars and stockbrokers to immobilize their shares. This will ensure the security of their investments and enable seamless trading, corporate action benefits, and faster transaction processing.”