More than 35,000 Airbnb operations find themselves in hot water.

They have been flagged for evading the tourism levy, a 2 percent fee meant to bolster Kenya’s tourism sector.

This crackdown by regulatory authorities follows the launch of a fresh registration drive aimed at bringing Airbnb hosts into the tax net.

Kenya’s Tourism Fund and other overseeing agencies have raised alarm over the hemorrhaging revenue.

READ ALSO: Details of Ruto’s phone call with US President Joe Biden

Additionally, there has been an increasing preference of Kenyans for opulent Airbnb accommodations over traditional hotels.

Levy requirement for all Airbnb owners

As a result, they’ve intensified efforts to ensure all Airbnb operators comply with the levy requirement.

According to the Tourism Fund, an exhaustive scan of Kenya’s online booking landscape is in progress.

Meticulously identifying and culling out those who neglect to remit the mandated 2 percent tourism levy.

It’s a matter of law, as Airbnb operations seamlessly fall under the broader ambit of tourism promotion.

Their objective is to establish a comprehensive system where all Airbnb entrepreneurs register and diligently remit their contributions to the tourism fund. Photo: Courtesy.

During a recent gathering of stakeholders within the North Rift Economic Bloc (Noreb).

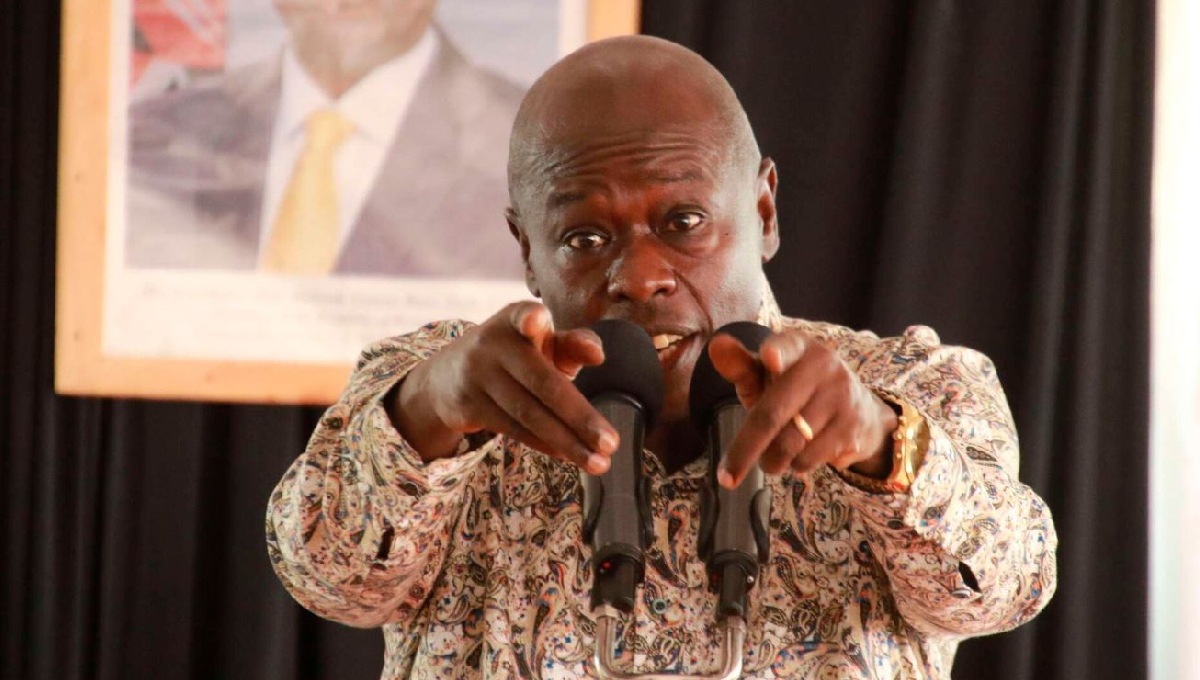

David Mwangi, the Chief Executive Officer of the Tourism Fund emphasized the legal obligation that Airbnb hosts bear.

Urging them to acknowledge that their primary service is providing accommodation.

READ ALSO: Michelle Ntalami sues media giant M-Net and influencer Minnie Cayy

Consequently, it is incumbent upon them to conform to the legal requirement of registering and faithfully remitting the 2 percent levy.

This levy is a critical financial resource for various tourism-related initiatives, infrastructure development projects, and promotional activities.

Taxes on Airbnb

Established under the Tourism Act of 2011, the Tourism Fund operates as a government corporation with a singular mission: to foster the growth of the tourism industry in the country.

As the regulatory authorities crack down on non-compliant Airbnb operators.

They’re setting the stage for a more robust and equitable contribution to the nation’s tourism endeavors.