President William Ruto on Monday, December 9 unveiled a new loan product of the Hustler Fund that will target good borrowers graduating from personal loan product to access an enhanced credit.

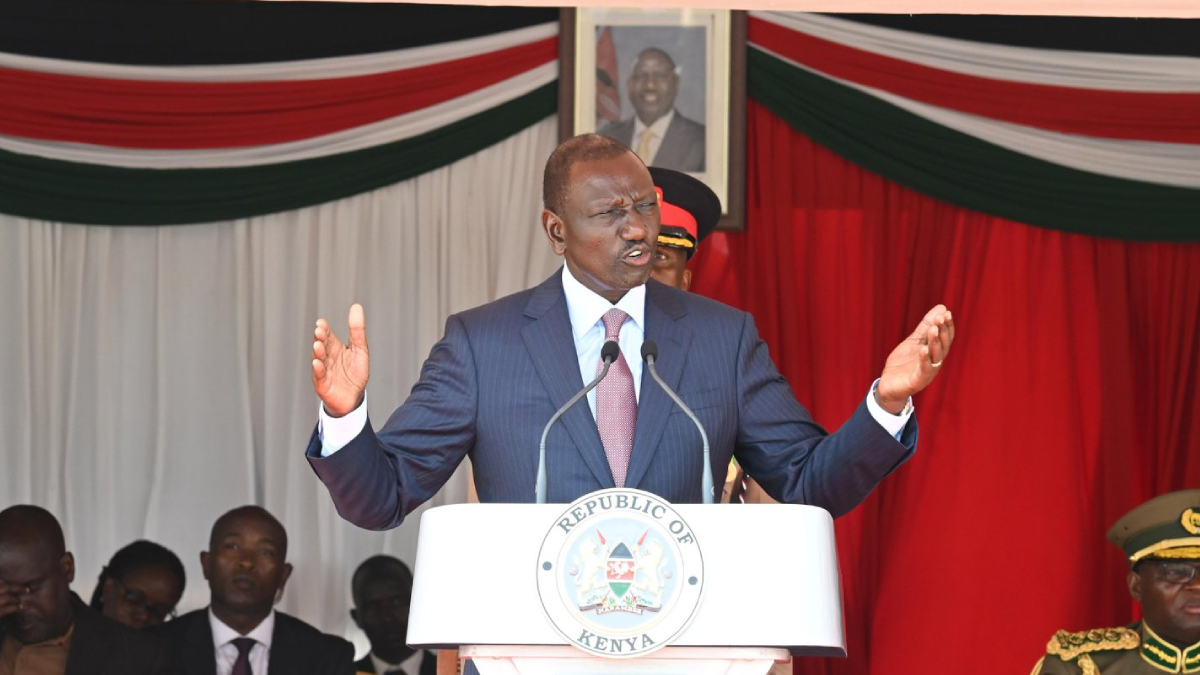

Speaking during the unveiling at KCB Headquarters, President Ruto said that over two million Hustler Fund beneficiaries had demonstrated good borrowing behavior over the last two years, and that their positive behavior will earn them access to enhanced credit loan.

Dubbed ‘Bridge Loan’, the product will target good borrowers graduating from the personal loan product and opens a new chapter for them to access enhanced credit limit based on their now established good credit history.

“The name Bridge signifies that this product acts as a bridge to greater financial opportunities within the Hustler Platform and the formal Financial sector,” President Ruto revealed. “It provides the beneficiaries with an opportunity to establish relationships with the financial institutions to experience the banking environment towards re-integration.”

According to the first in command, the Bridge loan experience is expected to transition good borrowers to the mainstream financing sector by exposing them to the banking environment.

This, President Ruto said, will enable the beneficiaries to start building relationships which identify and grows their enterprises through supportive ecosystem including business development service to earmark them for graduating to business focused loans.

Features of the Bridge Product

- A term loan of 30 days from the current 14 days on the personal loan with a rollover of a to 30 days @ 8% per annum and a one month roll with enhanced interest at 9.5%,

- Enhanced loan limit depending on the score of which some beneficiaries will enjoy triple or double their current limits,

- The beneficiaries will establish relationship with the banks to start gaining the banking experience and credit history to inform their bankability, and

- Limit refresh will be dependent on the Hustler Fund behavioral credit rating of the individual as they transact.

President Ruto added that the bridge loan customers will have an opportunity to access other investment opportunities including; investing in affordable housing, and premium health financing owing to their trusted credit history.

A section of Kenyans and politicians opposed to Hustler Fund have been making fun of the product, arguing that the small amount of money given cannot enable one to undertake a productive hustle. With the bridge loan, President Ruto said that Hustler Fund was addressing those concerns, and “if you are a good borrower, you will enjoy enhanced benefits.”

“To the Beneficiaries: The Hustler Fund is not an end—it is a means to an end. It is a pathway to greater opportunities, to better jobs, better businesses, and better futures. Borrow and repay to improve your credit rating for enhanced loan access. Financial institutions: Join us in embracing this first cohort of good borrowers and transition them to your balance sheet based on their proven credit worthiness,” President Ruto made a rallying call to Kenyans and financial institutions.