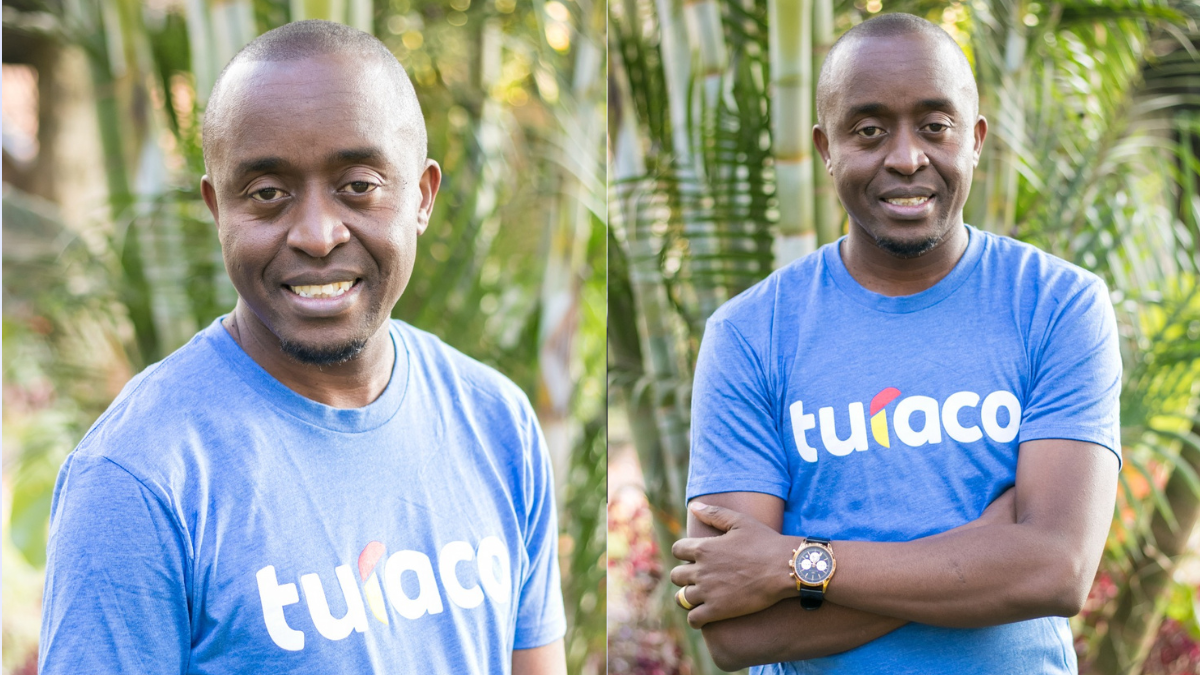

Former Pula Commercial Director Cedrick Todwell has been appointed as new Business Development Director for Turaco, effective from October 1, 2024.

Turaco is a Kenyan-based and Africa’s leading insurtech which provides affordable health and life micro-insurance across the African continent, and aspires to insure 2 billion people in the next 10 years.

“I am excited joining Turaco a company that has a track record of being customer centric, innovative and keeping its promise of paying claims on time when its due. In my new role, I will work closely with the team and like-minded partners to help Turaco accelerate Africa insurance penetrations from the current 3% to double digits ..”said Cedric.

During his tenure at Pula, Cedric was very instrumental in helping it scale their microinsurance products by working with Governments and private sectors across Kenya, Uganda, Mozambique , Ghana,and Malawi.

In 2018, the social entrepreneur Cedric Todwell was among Kenya top40under40 nominees.

Additionally, he has won several awards, for instance in 2018 he received the Change Makers award during the 100 Change Makers awards gala dinner in Johannesburg, for championing affordable clean energy in Africa.

“Turaco, has insured over 2.5 million lives, focusing on micro health, credit life, micro property, and life products that are designed, distributed, and serviced with the Kenyan mass market customer in mind,” said Todwell.

Turaco cutting edge starts from the innovative product design which are simple to use and affordable starting from Ksh100 premium per month, , a tele-sales approach that utilizes local and accessible language, to an automated claims process.

Turaco cares about paying claims and paying them fast; with our AI technology, we can pay claims to M-PESA or bank accounts within minutes of receiving full documentation,” he added.

Founded in 2019 by Ted Pantone, the company announced that it had reached a milestone of 2.5 million customers in Kenya, Ghana, Nigeria and Uganda.

Unlike other insurtech start-ups, Turaco places a greater emphasis on its customer-centric and high-touch distribution model which drives sales.

Turaco offers a wide range of products which are basically microinsurance products of Hospital cash, Funeral cover, credit life and micro-life.

The company has attracted reputable and notable clients such as Airtel, Vision Fund, One Acre Fund, M-KOPA, Letshego, Tugende and ABSA among others.

This has been achieved through coming up with a model that is designed to address the needs of this large unserved market.

In September 2022 the company raised a US$10 million Series A round and is using that capital to grow across its operating markets.

Turaco has partnered with telcos,saccos and microfinance banks to sell insurance products to their customers through the platforms.

The micro insurance company works in two ways, by selling insurance as a standalone product that customers can buy directly, or by embedding its insurance into partner products.

According to Turaco CEO, Ted Pantone, they are transforming the insurance industry by making it accessible and attainable for everyone.

“We strive to transform the way insurance works. Using our tech driven claims process, we facilitate claims payment fast -usually within a few hours of receiving claims documentation,” stated Ted Pantone.

“Our customer-centric team provides education and awareness on the value of insurance and ensures customers fully understand the product, terms and conditions, and how to claim,” he added.