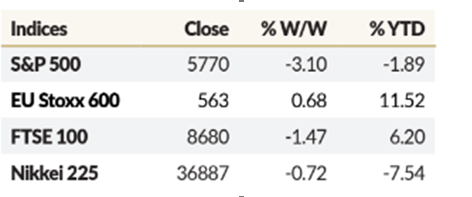

A game of tug-of-war where one team (the U.S. stock market) is weighed down by uncertainty, while the other team (European markets) is energized by a new wave of spending plans. That’s pretty much how the week played out, with trade policy uncertainty acting as the anchor dragging the U.S. markets down, while Europe’s plans for military and infrastructure spending provided a much-needed boost.

The stock market had a rough week, with the S&P 500 and Nasdaq both dipping into negative territory for the year. The main culprit? Uncertainty over trade policy. This week, that feeling was amplified by the looming deadline for President Trump’s tariffs. Tuesday was the day the clock ran out on his previously announced 25% tariffs on Canadian and Mexican imports, along with an additional 10% on Chinese goods. Think of it like this: Imagine you’re running a business that sells cars. Suddenly, the price of steel and parts from Canada and Mexico goes up by 25%, and the price of parts from China goes up by 10%. You have to figure out how to absorb those costs, which means raising prices or cutting profits, neither of which is ideal. But just when things seemed bleak, the Trump administration threw a lifeline to the market by announcing a slew of exemptions and delays for the tariffs.

Meanwhile, over in Europe, things were looking a lot brighter. European markets were soaring, fueled by a couple of big announcements. First, European leaders agreed to pool together a whopping EUR 150 billion to boost their militaries. Then, Germany, Europe’s biggest economy, announced a big plan to exempt defense spending above 1% of its GDP from its constitutional borrowing limit. This means they can spend more on defense without breaking the bank. To top it all off, Germany unveiled a EUR 500 billion infrastructure fund to boost their economy.

ENERGY CRISIS?

The energy sector in Africa will likely experience a new era in energy diplomacy after US Secretary of Energy Chris Wright told African energy ministries that Washington will not foster the transition into the continent. Instead, the US will support African countries to use whatever energy source, including gas and coal, to power their economies.

For decades, the United States has been a significant player in this effort, supporting the development of renewable energy sources and infrastructure. The US has traditionally championed the expansion of renewable energy in Africa, promoting solar, wind, and hydroelectric projects.

The US’s shift in energy policy towards Africa, as outlined by Secretary Wright, represents a significant departure from previous administrations and could have profound implications for the continent’s energy sector.

The decision to support African countries in utilizing whatever energy source they deem necessary, including fossil fuels like gas and coal, while abandoning initiatives like Power Africa, suggests a prioritization of short-term economic growth over environmental concerns. This approach, while seemingly empowering African nations to make their own choices, could lead to increased reliance on fossil fuels, hindering the transition to cleaner energy sources and potentially exacerbating climate change. However, it could also provide much-needed energy access to millions of Africans who currently lack reliable electricity.

This shift in US energy diplomacy raises crucial questions about the future of Africa’s energy landscape. The implications extend beyond energy access and security, impacting environmental sustainability, economic development, and geopolitical dynamics. The conversation will center on the long-term consequences of this shift, questioning whether it aligns with the shared goal of a sustainable and prosperous future for Africa.

Whether this constitutes a “paternalistic post-colonial attitude” or simply is killing financing for developing power generation on the continent is a matter of interpretation. The potential for a new scramble for resources between the US, China, and Russia in Africa is a real concern. China, in particular, has been heavily investing in African infrastructure and energy projects, often with less stringent environmental regulations. This shift in US policy could lead to a race to secure access to Africa’s energy resources, potentially exacerbating existing geopolitical tensions and further marginalizing African nations in the decision-making process.

This is a challenge to African leaders, to take the bold action. To move beyond dependence on Western funding and embrace a future where Africa’s energy is shaped by its own resources. Africa should invest in innovative solutions that harness the power of the sun, the wind, the earth and technologies that will pave the way for a clean energy future.

EQUITIES

According to a report done by Dan Murage, portfolio analyst – global markets, at Standard Investment Bank, it was a rough week for the stock market, with major indexes suffering their worst losses since early September. Think of it like a rollercoaster ride, but instead of going up and down, it just kept heading downwards. The S&P 500, Nasdaq Composite, and Russell 2000 all took a tumble, losing over 3% of their value. The Dow Jones Industrial Average, also took a hit, shedding 2.37% and wiping out most of its gains for the year. This downturn wasn’t across the board, though. Some sectors were hit harder than others. Tech stocks, which had been soaring earlier in the year, took a particularly hard fall, reflecting investor concerns about rising interest rates, tariffs and slowing economic growth.

European markets had a bit of a shaky week, with investors worried about geopolitical wars and the threat of more trade tensions with the U.S. The Stoxx 600, a broad index that tracks the performance of European stocks, lost ground, erasing any gains from the previous week. But there was one bright spot in the European market: defense stocks. With European leaders increasing their military spending, companies that make weapons and other military equipment are seeing a surge in demand. The European aerospace and defense sector index, which tracks these companies, soared by a record 7.7% on March 3rd.

Europe is trying to reduce its reliance on U.S. weapons, but it’s not an easy switch to make overnight. More like deciding to ditch your old car for a new one, but realizing you need to find a new mechanic and learn how to use a different gas pump. Europe needs to support its own defense industries and find new partners to work with. It takes time to find the right players and get them to work together. This shift is already happening, with Israeli and South Korean defense companies seeing a boost in interest. Elbit Systems, an Israeli defense contractor, saw its stock jump 8.1% on March 3rd. So while Europe is moving away from its reliance on U.S. weapons, it’s looking to new partners and strengthening its own defense capabilities. It’s a big change, but it’s one that’s already underway.

CURRENCIES

The Euro had a great week, bouncing back from a three-day slump and ending at its highest point against the US Dollar in a while, closing the week at 1.08880. This rally was fueled by comments from the European Central Bank (ECB) president, Christine Lagarde, who said that interest rates are now “meaningfully less restrictive.” Basically, the ECB is easing up on how aggressively they’re raising interest rates, which is good news for the Euro. The central bank also revised its projection for inflation to 2.3% for 2025, up from the 2.1% expected three months ago. Meanwhile, the Japanese Yen is also doing well, hitting its highest point in five months against the US Dollar, strengthening past 148.00. This is because investors are worried about a possible trade war and a slowdown in the US economy. When things get uncertain, people tend to invest in safe havens like the Japanese Yen. Adding to the Yen’s strength, the Bank of Japan (BOJ) is expected to keep interest rates low at its upcoming meeting. This means that investors are more likely to hold onto their Yen, making it even stronger.

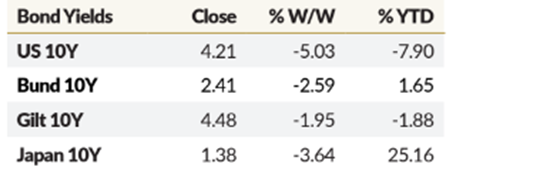

BOND MARKET

The global bond market saw some interesting shifts this week, with yields moving in different directions, reflecting a mix of economic concerns and policy expectations.

In the U.S., the 10-year Treasury yield, which is a key benchmark for borrowing costs, edged slightly higher after Fed Chair Jerome Powell’s comments. Powell reassured investors that there’s no immediate need to cut interest rates, but he also acknowledged the lingering uncertainty caused by trade tensions and other policy issues. This cautious approach by the Fed is reflected in the widening spread between the 2-year and 10-year Treasury yields, which is now at 30 points. This spread is a measure of the difference in interest rates between short-term and long-term debt, and a widening spread often suggests that investors are expecting slower economic growth in the future.

Across the Atlantic, Germany’s 10-year Bund yield saw its biggest daily jump since the fall of the Berlin Wall in 1990. This surge was driven by expectations of increased government spending aimed at revitalizing Germany’s struggling economy and bolstering its defense capabilities. This move indicates that investors believe Germany is ready to loosen its purse strings to stimulate growth, which would likely lead to higher borrowing costs.

In Asia, the yield on Japan’s 10-year government bond reached its highest level since 2008, climbing to 1.53% from the previous week’s 1.37%. This increase is fueled by expectations that the Bank of Japan (BoJ) will continue raising interest rates this year, a move that would bring Japan more in line with global interest rate trends.

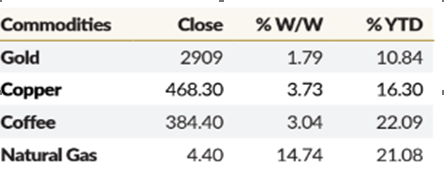

COMMODITIES

The energy markets have been on a wild ride this week, with natural gas prices skyrocketing and gold holding steady. Natural gas prices have surged to their highest levels in months, driven by a perfect storm of factors. Freezing temperatures across the US have led to a surge in demand for heating, while production has been hampered by freeze-offs and disruptions. On top of that, record exports of liquefied natural gas (LNG) have further tightened supply.

Gold prices have remained relatively stable, hovering above $2,900 per ounce. This stability comes despite some uncertainty in the global economy and rising interest rates in the US. Analysts are predicting that gold could reach $3,250 per ounce by the end of the year, suggesting that investors are still looking to gold as a safe haven asset.