The Kenyan government now seeks to tap phone calls and email messages of specific individuals if the latest intended legislation will see the end of the day.

In the Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill, 2023, the state wants to be allowed to tap the communication of Kenyans suspected of laundering money and financing terrorism.

“Where a person is suspected or accused of an offence under this Act, the privacy of a person’s communications may be investigated or otherwise interfered with,” the proposed amendment reads in part.

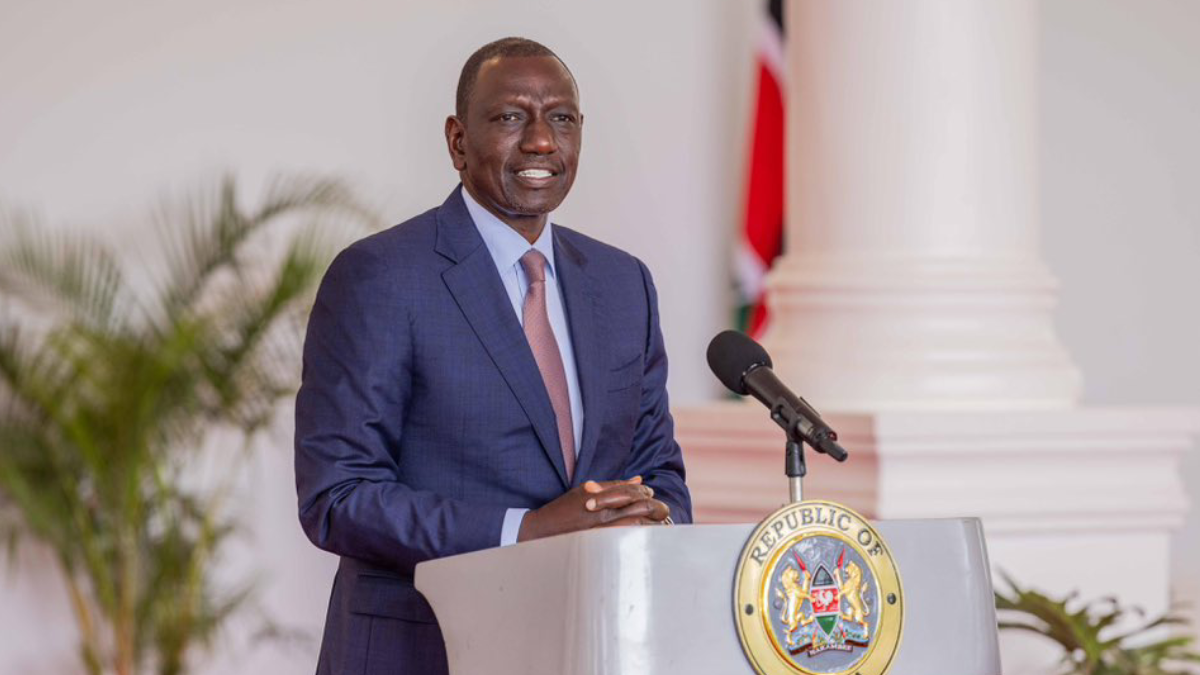

In a sitting in July 2023, the Cabinet approved the bill, setting the stage for introduction and consequent approval or rejection by Parliament.

According to the Office of the President, the new legislation introduces new measures to identify and prevent money laundering in the country.

“Reporting entities will get the mandate to report suspicious transactions and activities to the Financial Reporting Centre (FRC) promptly. The FRC will analyse the reports and share intelligence with relevant law enforcement agencies that will, in turn, initiate investigations and take appropriate actions against money laundering perpetrators,” the Presidency said in a statement.

If the August House approves the proposed amendment, the state total access to communications of persons as security agencies step up the fight against money laundering and terrorism financing.

The National Payments Systems Act, the Central Bank of Kenya Act, the Capital Markets Act, the Banking Act and the Insurance Act, are the five amendments that have been singled out by the Bill, that need to be effected.

The International Monetary Fund (IMF) has called on Kenya to effectively deal with money laundering. In a report in 2022, the Eastern and Southern Africa Anti-Money Laundering Group accused Kenya of non-prosecution of persons involved in money laundering and terrorism financing.

“A poor understanding of money laundering risks, lack of collecting statistics on different money laundering types and the prioritisation of the prosecution of predicate offences, especially corruption, over money laundering have limited Kenya’s ability to effectively investigate and prosecute ML cases in line with its risk profile,” the group said in a report.

The IMF, the World Bank, the United Kingdom (UK) and the United States of America (USA) are some of the members of the Eastern and Southern Africa Anti-Money Laundering Group.