Content creators in Kenya may soon face new taxes on their earnings.

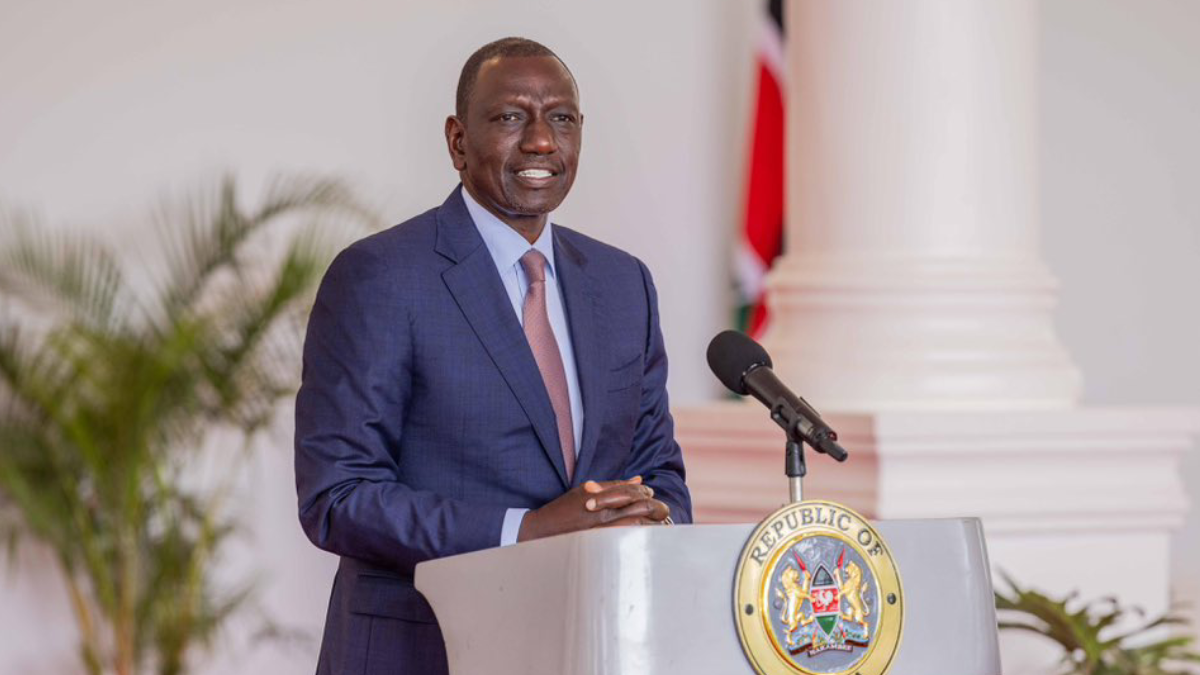

President William Ruto recently shared plans to introduce taxes for digital creators, who benefit from monetization of platforms like Tiktok, Facebook, and YouTube.

This comes after a deal the government negotiated earlier this year to help creators earn from their content.

Speaking at the 20th-anniversary celebrations of the Kenya Private Sector Alliance (KEPSA) in Nairobi, Ruto explained the reasoning behind the move.

He emphasized fairness, stating that everyone who earns an income should contribute to taxes.

“I negotiated with Tiktok and Facebook, making Kenya one of only four countries where creators can monetize their accounts,” he said.

“Some creators now earn up to Ksh.1 million. Someone earning Ksh20,000 or Ksh30,000 pays tax, so if you earn Ksh1 million, isn’t it fair to contribute something to the tax kitty? Especially when we’ve enabled you to achieve that? I think that makes sense, at least to me,” he added.

The government has proposed the Tax Laws (Amendment) Bill, 2024, to include digital operators under the tax net.

The bill has undergone public participation and is now headed for a Second Reading in Parliament. If passed, it will affect creators earning income from platforms like YouTube, Tiktok, and Facebook.

In April 2024, the government signed agreements with Google, META, and Tiktok, making it easier for Kenyan creators to earn money from their work.

“Our highly talented youth are capable of creative excellence in diverse fields such as music, theatre, graphic design, and virtual reality,” Ruto noted at the time.

Ruto’s statement that Kenya is one of four countries with content monetization opportunities has raised eyebrows. According to YouTube’s monetization policies, 12 African countries, including Kenya, are eligible for monetization. These include nations like Nigeria, South Africa, Uganda, and Egypt.

For Meta, monetization has been available but was primarily focused on partnerships with brands and sponsored content.

The president argues that taxing content creators will level the playing field. Traditional workers earning lower salaries already pay taxes, so it’s fair for high-earning digital creators to do the same.

However, some content creators feel this might discourage their growth.